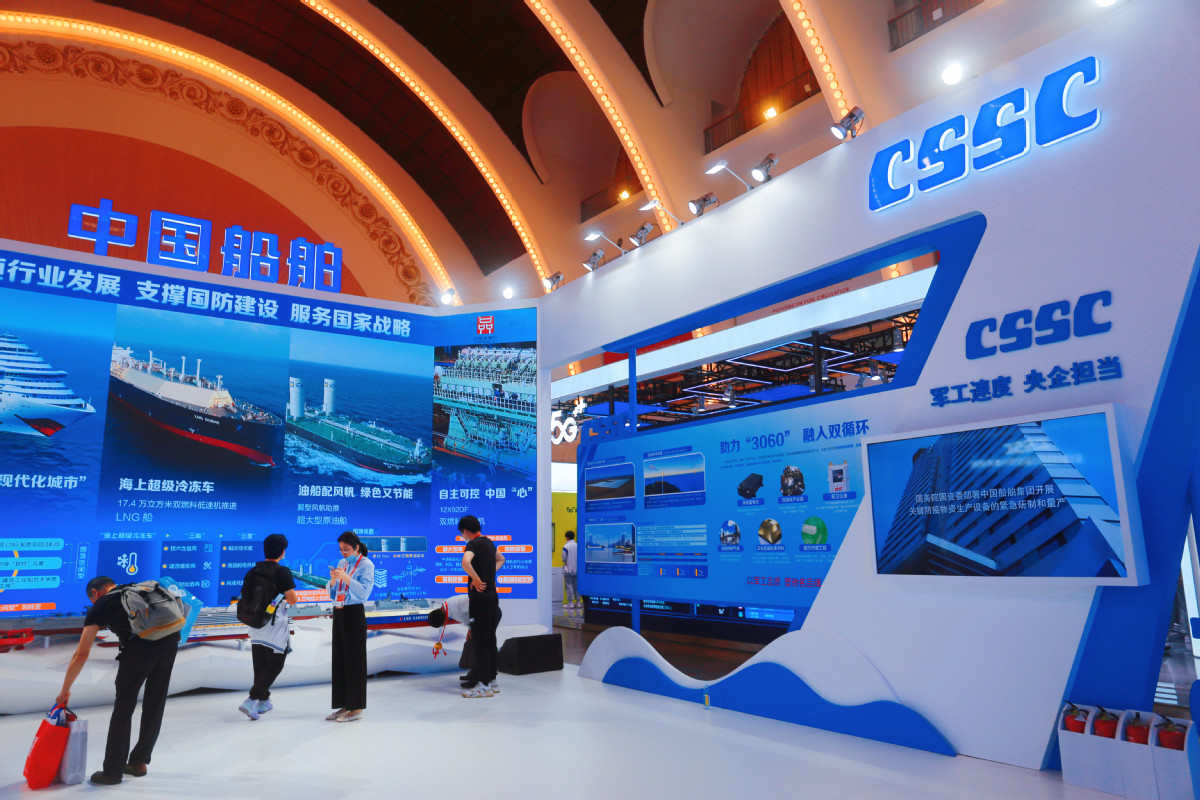

Asset integration makes CSSC shipbuilding giant

Restructuring and rationalization of China's State-owned enterprises as part of the larger corporate reform and optimization process reached a significant milestone this week with the equity transfer of nine listed subsidiaries to China State Shipbuilding Corp Ltd, or CSSC, experts said.

CSSC itself is the merged entity of two erstwhile State-owned shipbuilders-China State Shipbuilding Corp and China Shipbuilding Industry Corp-that came together in late 2019 to boost the nation's shipbuilding industry.

Three listed subsidiaries of the erstwhile China State Shipbuilding Corp, including CSSC Science and Technology Co Ltd and CSSC Offshore and Marine Engineering (Group) Co Ltd, and six listed firms of former China Shipbuilding Industry Corp, including China Shipbuilding Industry Group Power Co Ltd, announced in separate notices late on Thursday that all of them will unconditionally transfer their equity stakes to CSSC, as part of a major merger process.

Once the stake transfers are formalized, CSSC will own controlling stakes in the nine companies.

That will make it a State-owned shipbuilding behemoth with enough corporate heft to dominate several industry segments like liquefied natural gas or LNG carriers, luxury cruise liners, icebreakers and offshore engineering equipment.

CSSC is expected to help lead China toward independent innovation in the growth of high-end ships. Its merged form will reposition and integrate the company's assets on the stock markets, said Dong Liwan, a professor of shipbuilding at Shanghai Maritime University.

The nine listed companies also said in their notices that after the completion of the stake transfers, CSSC will be able to optimize core capacities to focus on the development of marine defense equipment, ships, offshore equipment and technology application industries, as well as the marine service business to build a world-class shipbuilding group.

Such a group will have a reasonable industrial structure, stand for quality, deliver efficiency, and build strong international competitiveness, Dong said.

"Because the group will have a number of research institutes with quality assets, CSSC's asset integration will be more clear and predictable in coming years."

The group's asset securitization rate will also gradually increase and bring tangible benefits to its listed companies, he said.

Until now, the two erstwhile State-owned shipbuilders, and their subsidiaries, had many things in common, including business pursuits, analysts at China Galaxy Securities said.

After the stake transfers are completed, CSSC may be able to carry out more intra-industry mergers of its listed firms to avoid cannibalization in coming years.

Reestablished in October 2019, CSSC currently has 347,000 employees, 113 subsidiaries, including shipyards, research facilities, training institutes and manufacturing complexes.

It will be the main force in research, design, manufacture, testing and supply of various vessels. The group manages assets valued at 840 billion yuan ($129.6 billion).

In their previous incarnations, the two big shipbuilders had experienced both booms and struggles of China's civil shipbuilding industry.

The 2008-09 Global Financial Crisis dealt a heavy blow to the shipping industry, said Li Jin, chief researcher at the China Enterprise Research Institute in Beijing, adding the strategic restructuring, coming a decade later, has been in accordance with the government's measures for optimizing quality industrial resources and pruning backward production capacities.

Thanks to the merger, constituent corporate entities of CSSC will be able to join forces to handle pressure and compete for new orders, as well as inject momentum into the sector and reduce unnecessary competition among domestic shipbuilders, said Zhou Lisha, a researcher with the State-owned Assets Supervision and Administration Commission, which is part of the State Council, China's Cabinet.

"The shipbuilding industry has become more intelligent, digitalized and environmentally friendly," she said, stressing it will take time for the two former shipbuilding giants to operate effectively as a fully merged entity complete with the control of stakes of their subsidiaries. The constituent companies of the group must accelerate the pace of internal integration and cooperation to achieve optimal governance.