US chip restrictions backfiring

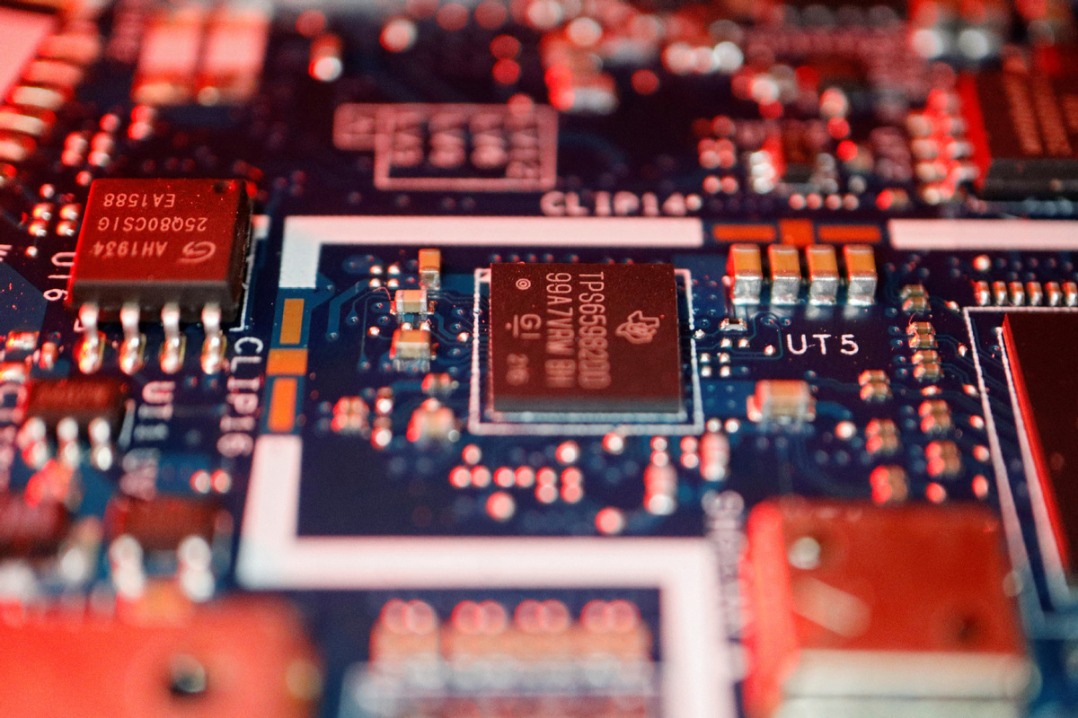

Despite the United States maintaining a significant lead in AI chip technology, China's rapid progress in AI chip production and development is noteworthy. However, efforts by the US to impede China's AI advancement through export restrictions may ironically yield counterproductive outcomes.

Jensen Huang, CEO of NVIDIA, normally refrains from making political remarks to avoid upsetting the US administration, but he issued a strikingly candid critique of the administration recently. Criticizing the administration for imposing harsh export restrictions to limit China's access to AI chips, he said the measures have been a "failure" because they have prompted China to accelerate its product development and launches.

In a pointed denunciation of the successive US administration's chip policies, the head of the leading AI processor manufacturer objected to Washington's decision to prohibit NVIDIA's innovations tailored explicitly for the Chinese market. The prohibition is projected to cost NVIDIA $8 billion in sales in the second quarter of this year.

Huang said the US administration's export restrictions have benefited Chinese competitors, particularly Tencent and Huawei, as they have developed competitive AI hardware. He said that four years ago, NVIDIA held a 95 percent market share in China, but today, that figure has dropped to 50 percent. He added that the remaining market share is dominated by Chinese technology, suggesting that there is a wealth of local technology that would be utilized if NVIDIA were not in the picture.

But Huang's remarks contain some inaccuracies. Chinese companies began developing chips well before the US administration took any discriminatory measures. Why? They foresaw that the US would take such measures.

A key aspect of China's success is its commitment to long-term planning, often extending decades into the future. Years ago, the Chinese leadership realized their country would have to compete with the US, particularly in high-tech, modernization, and high-quality development.

Last year, due to the US new round of export restrictions, four government-supported industry groups, accounting for a large percentage of China's semiconductor demand, released synchronized statements encouraging their members to reassess their purchase of US chips, referring to some as "less secure or reliable".

Acknowledging the advancements China has made in AI chip technology, the United States has cautioned American companies against utilizing these chips, including Huawei's Ascend processors, to hinder global proliferation. China's Commerce Ministry condemned the move, urging the US to "immediately correct its mistakes" and cease "discriminatory" practices.

Anticipating the possibility the US taking discriminatory actions, China has devised countermeasures to challenge US companies economically. For example, China is ready to ban the export of gallium and germanium to the US, in the production of which it has a near-monopoly. The ban on the export of just these two elements, according to US Geological Survey calculations, could cost the US$3.4 billion.

The discriminatory policies of the US have caused considerable concern among US chip manufacturers, especially because Chinese enterprises' share is about 50 percent of the global smartphone market and 15 percent of the computer market.

For instance, China accounted for 27 percent of Intel's sales and 13 percent of NVIDIA's sales last year. Qualcomm, too, earned about half of its $39 billion annual revenue from China.

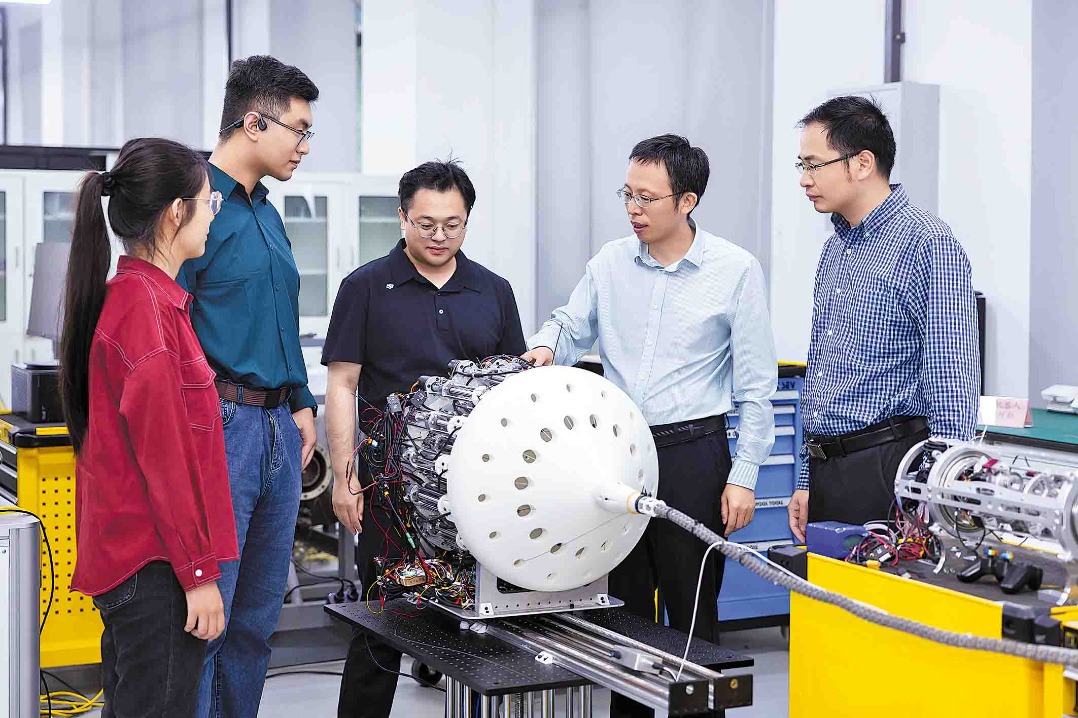

And Arizona-based onsemi estimates that its chips are used in half of the electric vehicles in China. Despite being the biggest purchasers of US-made chips for years, Chinese companies were investing heavily in chips R&D. As a result of rising localization, not only Chinese companies but also some foreign companies operating in China are purchasing semiconductors made in China. A notable example of such a foreign company is German auto parts manufacturer Bosch, which presented its "localized chip solution" for a steering system at a supply chain exhibition in Beijing, while China's State Grid displayed electrical equipment powered by Chinese CPUs and microprocessors.

According to Huang, the US should focus on maximizing and accelerating AI diffusion rather than restricting it.

This once again shows that interference in competition in global markets harms those who engage in it. In a bid to help US manufacturers, the administration's misguided efforts have led to the opposite outcome. Once again, it has been proved that long-term planning is a key strength of Chinese regulators and businesses. It has been proven time and again that companies can thrive only in a fair, competitive environment. But unfortunately, the US administration stubbornly "steps on the same rake". It's time it started learning from its mistakes.

The author, former prime minister of the Kyrgyz Republic, is a professor at the Belt and Road School of Beijing Normal University.

The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.