|

|

|

|

|||||||||||

|

Fosun International Ltd, a privately owned conglomerate, plans a series of overseas investments this year in countries such as Germany, Britain and Japan, Chairman Guo Guangchang said on Thursday.

Guo said Fosun is looking closely at investment opportunities in companies with advanced technology in Germany and Britain, as Europe's economic woes have led to "attractive valuations" for many companies in the region.

He also expressed interest in Japan's tourism and culture sector, which is being boosted by an influx of Chinese tourists.

"This year will see quite a few overseas investments by Fosun. We seek to improve our investment structure and its global distribution," said Guo in Beijing during the annual session of the National People's Congress.

Guo added that potential investment targets must have sound management, strong growth potential and, more importantly, synergy with Fosun's existing businesses, as well as the potential to expand in the Chinese market.

Guo said he wants Fosun's investments to be "meaningful", adding that the company will seek stakes of 10 to 30 percent and board positions.

All of Fosun's existing overseas investments involve stakes of less than 10 percent.

To finance new acquisitions, Fosun plans to raise another US-dollar-denominated private-equity fund this year.

It formed a $600 million fund last year with Prudential Financial Inc, a US financial services giant.

Fosun's business ranges from property, steel, pharmaceuticals and retailing to financial services and private equity investment.

Founded in 1992, Fosun has directly or indirectly invested in more than 100 companies, including outdoor advertiser Focus Media Holding Ltd and Nanjing Iron & Steel Co Ltd.

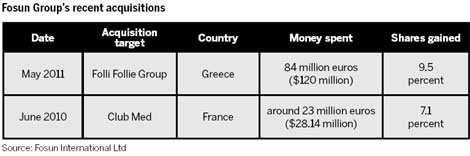

Fosun's global ambitions blossomed after two ground-breaking investments in Europe over the past two years, which Guo said had been "very successful".

In May 2011, Fosun paid more than 84 million euros ($120 million) for the Greek jewelry and luxury goods retailer Folli Follie Group.

Folli Follie's business has since boomed in China, a market it entered more than a decade ago. In June 2010, Fosun bought 7.1 percent of holiday resort operator Club Mediterranee SA. It was the first time that a public Chinese company had taken a direct holding in a listed French company.

Guo said Club Med plans to open its second resort in China in August this year.

By 2015, Club Med aims to be operating five resorts in the world's second-biggest economy, he said.

In the domestic market, Guo said he is waiting for the details of the "New 36 Clause", a rule that allows private companies to invest in sectors previously monopolized by State-owned enterprises, to deepen Fosun's involvement in the country's finance, high-end medical and culture sectors.

gaochangxin@chinadaily.com.cn