China's consumer prices rose by 1.6 percent from a year earlier, the lowest in a year, compared with a rise of 2 percent in August. The low reading creates room for policy adjustments as the economy weakens.

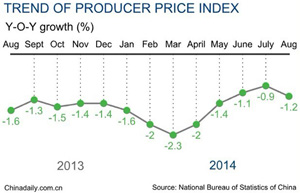

The factory-gate producer prices dropped by 1.8 percent, compared with a 1.2 percent fall in the previous month. It has been on the decline since February 2012 thanks to slumping commodities prices, China's overcapacity problem and weak demand as a result of the economic slowdown.

Previously, some data, such as the industrial output growth, also pointed to weak economic activities as the world's second-largest economy suffers from slower growth pace.

Policymakers have vowed to tolerate slower GDP growth rates as they push forward reforms and restructuring. They will not easily bow to the market pressure for expanded stimulus measures to keep the economy rolling.

The unexpected rise in foreign trade in September and the higher-than-expected manufacturing activity index have provided new ground for their insistence. Only that the employment sub-index of the Purchasing Managers' Index, released upon the start of the month, has thrown some cold water after the jobs measure fell to 46.9, the lowest since February 2009, when the country was hit hard by the global financial crisis and shed millions of jobs.

Therefore, the economic data have so far sent complicated signals, with most of them pointing to poor growth prospects despite some silver lining in the cloud.

Policymakers may continue its current hands-off stance and refuse to release new stimulus measures. But as more data come out and sour, they are facing heavier pressures for them to take action.

One of the factors that holds back policymakers from taking bigger stimulus measures is the fear of stoking inflation. Now as the low inflation reading comes out, policymakers are set to achieve its annual inflation control plan and it becomes easier for them to make bolder decisions if the economy continues to sour as inflation no longer poses any threat for the country's economic stability this year.

Actually, last month the central bank cut the 14-day repo rate by 20 basis points to 3.5 percent in its bi-weekly open market operations. It also cut the rate by 10 basis points in July.

The move has been widely interpreted as a sign of the central bank becoming willing to use tools other than direct interest rate cut to guide interest rates lower and boost the economy.

The central bank has resorted to targeted cuts in the banks' reserve requirement ratio and other tools to encourage bank lending to the real economy as direct interest rate cut remains controversial among economists and major policy advisors.

|

|

|

| China's August PPI down 1.2% | Economists upbeat on China |