Home prices decline in suburbs

Updated: 2011-10-25 09:07

By Hu Yuanyuan and Wang Ying (China Daily)

|

|||||||||||

|

A group of early homebuyers, who purchased their apartments from Longfor Properties Co Ltd, protested price cuts and demanded a refund in Shanghai on Oct 22.[Photo/China Daiy] |

Cash-strapped developers lower cost to boost funds amid grim forecasts

BEIJING / SHANGHAI - Home prices in China's key cities are falling more quickly as property developers, under increasingly tight cash-flow pressure, are cashing in as pessimistic forecasts are issued for the property market.

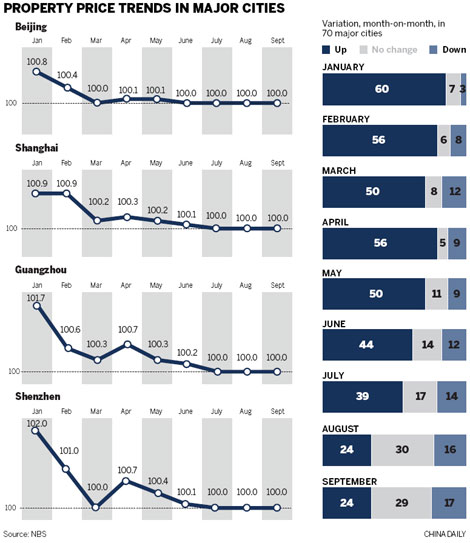

Though data from the National Bureau of Statistics show the month-on-month price remained unchanged in Beijing, Shanghai, Shenzhen and Guangzhou from July to September, home prices fell from 30 percent to 50 percent in the suburban areas of these cities.

Chen Li, head of China Equity Strategy at UBS securities Co Ltd, said fluctuations in the property market may pose the biggest challenge to China's economy next year.

"The decline in home prices, I believe, is just beginning. And this price adjustment will cut deeper than was the case in 2008 to 2009," Chen said.

The higher-than-expected price decline has triggered strong protests from earlier buyers.

In Shanghai, nearly 300 agitated people stormed the sales office of a property project in the Jiading district on Saturday afternoon, shouting for an immediate refund as the project price slumped up to one-third since they bought the houses.

The early homebuyers, who purchased properties from Longfor Properties Co Ltd, felt they had been tricked when they learned the average price of the project dropped from a peak of 18,500 yuan ($2,900) a sq m to 14,000 yuan a sq m, Shanghai Youth Daily reported.

Also on Saturday, another group of homeowners gathered outside the sales office of China Overseas Property Group Co in the Pudong New Area protesting the price cut from 23,000 yuan a sq m to 17,000 yuan a sq m, Securities Times reported.

A similar scene played out about a project in the Jiading district developed by Greenland Group, whose price shrank 8,000 yuan a sq m.

James MacDonald, head of Savills China research, regarded the incident at the Jiading district on Saturday as a one-off case.

"It could have been that the developer promoted the project at a price that was too high for the market to accept or it could be due to the individual developer's finances. However as a strata title retail project it represents a relatively unique case," he said.

In Beijing's Tongzhou district, the price of a landmark residential project has been nearly 50 percent off the peak price, triggering a violent conflict between earlier homebuyers and the property developer.

These price cuts that led to these conflicts are an indication of how tight the working capital of the once cash-rich property developers has become, according to Huang Zhijian, executive director of Uwin Real Estate Research Center in Shanghai.

Wang Gehong, president of Beijing Grand China Real Estate Fund, said some property developers are seeking financing from the fund even though they've got all the licenses ready for a sale, a situation that has seldom happened in the past.

"Their financing cost also rose quickly to around 30 percent or even higher, compared with the central bank's 6.56 percent one-year benchmark lending rate," Wang said.

A similar situation is found with high-end residential projects.

Helen Chang, director of Savills Residential Beijing, said that even though the price of high-end luxury apartments is not likely to plummet as other residential units did, it will definitely stop rising.

"In fact, the property developers of luxury apartments are also not optimistic about the market and quickened their pace in launching products to cash in," said Chang.

Upper East Side, a luxury apartment project along Beijing's central business district, for instance, is open for sale amid the sluggish market, with the price of its duplex units around 10 percent lower than the market price of comparable properties at the same location.

According to Chang Zhi, an analyst for Century 21, a US-listed real estate company, the effects of the latest round of policy tightening are stronger than expected.

"Only the property developers who cut prices first and offer a bigger discount could get some cash back," Chang Zhi said.

According to Chen at UBS, because the supply will greatly increase in the fourth quarter, especially in third- and fourth-tier cities, the price decline will be even more obvious around the end of the year.

"Moreover, once people's expectations for property prices have changed, even if the policy on limiting the home purchase were canceled, it is doubtful that people will still rush to buy property," said Chen.

In the past decade, most Chinese have seen buying property as almost a 100 percent safe investment, but now they should be more critical, attaching more importance to the location and the city, Ren Zhiqiang, chairman of Huayuan Real Estate, said at a sina.com forum on Monday.

According to MacDonald, the next two and a half months are going to be particularly difficult for the residential market as it has been reported that a number of commercial banks have reached their loan quotas for the year and will therefore be unable to issue mortgages, while other banks are steadily increasing first-property mortgage rates above the base lending rate.

"This will make it increasingly difficult for buyers unless they are able to buy properties without mortgages," he added.