Cash crunch puts squeeze on securities

|

The People's Bank of China suspended the issuance of central bank bills and repurchase operations last week to soothe liquidity tensions. [Photo / Provided to China Daily]

|

Bond offerings cut as banks blame fluctuation in market liquidity

Slowed capital inflows have added to the worst cash crunch in China for at least seven years, which is hampering securities trading, experts said on Tuesday.

The Agricultural Development Bank of China, a major policy bank, cut the size of two bond offerings on Tuesday by 31 percent, by selling 8 billion yuan ($1.3 billion) of three-year notes, down from its previous target of 13 billion yuan.

It also reduced an issue of five-year debt to 10 billion yuan from 13 billion yuan, blaming recent fluctuations in bond market liquidity as the main reason.

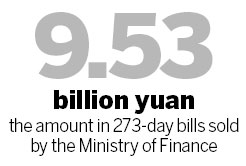

On Friday, the Ministry of Finance sold 9.53 billion yuan of 273-day bills, less than the target of 15 billion yuan, the first time that sales of treasury debts had missed the issuance target in the past 23 months.

Institutional demand for securities has declined as the seven-day repurchase rate, a measure of interbank liquidity, averaged 6.03 percent in June, the most since the National Interbank Funding Center began compiling a weighted average in 2006, according to data compiled by Bloomberg.

Wang Tao, head of China economic research at UBS Securities, said those and other recent moves reflected how the central government has increased its tolerance of an economic slowdown and attached more attention to containing financial risk.

Wang said a substantial decrease in foreign exchange inflows in May was a major factor contributing to the surge in inter-bank interest rates.

According to data released by the central bank last Friday, yuan positions among commercial banks involved in foreign exchange purchases, an indicator of capital inflows, rose 66.86 billion yuan in May, the smallest increase since November.

The figure has dropped from April's increase of 300 billion yuan, and 400 billion yuan on average during the first quarter of the year.

Wang said she estimated non-direct investment capital inflows in May had dropped to $9 billion from $40 to 50 billion between March and April, after China's foreign exchange watchdog tightened regulation of cross-border capital flows last month.

"The banks' underestimation of capital demand in June has also led to less liquidity and dramatic interest rate hikes, as they extended more loans in early June," Wang said, adding they also misunderstood the central bank's intentions.

Guo Tianyong, a professor at the Central University of Finance and Economics, said that as China's economic data had disappointed analysts, and the inflation rate remained at a relatively low level, the market had been expecting the authorities to further loosen its monetary stance, for instance, by cutting interest rates.