|

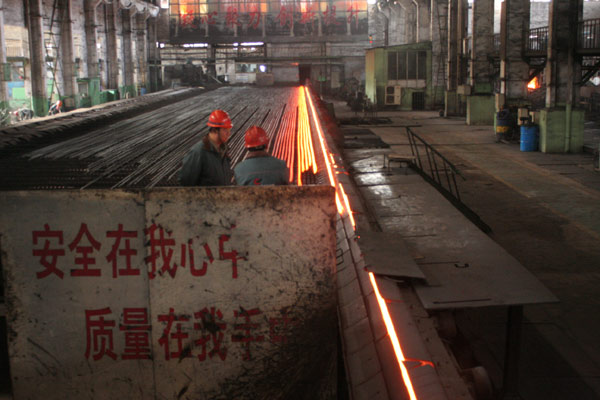

The total debt of major Chinese steel firms rose 6.5 percent to 3 trillion yuan ($489 billion), according to a report by the Ministry of Industry and Information Technology. [Photo / Provided to China Daily] |

Domestic steel makers expanded their output blindly in the first half despite sliding profits, which led to a severely unbalanced demand/supply relationship and may damage their financial safety, a report warned on Monday.

The total assets of major Chinese steel firms grew 4.3 percent year-on-year to 4.3 trillion yuan ($696.14 billion) from January to May, and their total debts rose 6.5 percent to 3 trillion yuan, pushing up the average debt-asset ratio for these companies by 1.4 percentage points to 69.4 percent for the period, said a report released by the Ministry of Industry and Information Technology on its website.

Financing difficulties and growing funding costs were the major problems faced by domestic steel companies in recent years. During a regular meeting in June, the State Council, or China's cabinet, ordered financial institutions to stop providing new credit lines to industries mired in oversupply.

Wang Guoqing, deputy director at the Lange Steel Information Research Center, said that steel makers are finding it harder to stay profitable.

"The major steel makers' return on sales was merely 0.13 percent on average in the first half, and the ratio even swung to a negative 0.23 percent in June after posting losses of 699 million yuan," Wang said.

Most steel makers reinvested their profits in production expansion projects in the last few years, and their capital resilience is very weak, said Zeng Jiesheng, an analyst with Mysteel.com, a provider of information for the steel market.

Beijing Shougang Group's Caofeidian project is one of the money-losing investments. Shougang Group has invested roughly 67 billion yuan in total on the project, with 45 billion yuan coming from bank loans. But the supply glut and the slowing economic growth made the project a hot potato for the steel group. Shougang had to spend 9.2 billion yuan in interest payments and pay 1 billion yuan in wages annually, according to a report in China Business News, citing an unidentified source from the project.

Rapidly mounting steel inventories across the nation reinforce evidence of a miserable year for steel mills. Data from the ministry's report showed that China's steel stockpiles reached a historic level of 22.52 million tons on March 15, with construction steel accounting for 63.6 percent of total stocks, or 14.32 million tons.

Although inventories have now declined from the peak in mid-March, the total stocks by end-June were still 29.9 percent higher than in early January, and were up 11.4 percent from the same period in 2012.

"Here's the dilemma: steel firms cannot stop production or cut output because they don't want to lose their market shares, and banks will cut off loans if they stop production or downsize their output. The flipside of the coin is that the more they produce, the more stocks they will have, which leads to a fiercer price war and thinning profits," said Wang.

In spite of all the difficulties, according to Zeng, major steel firms will get aid from local governments if they face severe financial difficulties, because steel is the country's pillar industry.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant