For more on Chinese overseas acquisitions, we're joined in the studio by my colleague Wu Haojun.

Wang: Investment by Chinese companies overseas is actually nothing new. But what seems to be new here is that we're seeing more and more private companies like Meijing Group buying assets that have nothing to do with natural resources. Tell us more about that.

Wu: Yes, you're absolutely right. It wouldn't be an overstatement to say natural resources was pretty much all that China cared about in terms of overseas deals in the past. BUT, as the Chinese economy matures, so do investment targets. Now we're increasingly seeing non-state owned companies in industries like technology, real estate and food buying assets overseas. Private or non-state-owned publicly listed companies first began exploring overseas deals en masse in 2004. 45 deals valued at 3.7 billion dollars were struck that year. So far this year, 238 overseas deals valued at over 24 billion dollars have been struck by China's private companies. Just to name a few, there's the 7.1 billion dollar acquisition of American pork producer Smithfield by Shuanghui. There's also personal-computer maker Lenovo, who said it's considering a bid for the struggling BlackBerry.

Wang: What can you tell us in terms of the government's involvement in these overseas acquisitions? Is it helping these private companies?

Wu: Well, it's fair to say that without government support, a lot of private companies simply wouldn't have been able to pull off these deals. Last year, 10 government departments jointly issued what they called "opinions" about actively encouraging private companies to make acquisitions abroad. This included one detailed regulation which relaxed certain aspects of foreign exchange control, which is tied to outbound investments. And these opinions had a clear impact. Analysts point to Shuanghui's takeover of Smithfield as the best example of this. The State-owned Bank of China was quick to offer up 4 billion dollars of financing. And this isn't an isolated case. The Industrial and Commercial Bank of China provided a total of 15.8 billion dollars in loans, just for the first half of this year, to finance overseas acquisitions by private companies.

Find more in

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

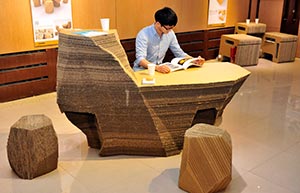

Paper-made furniture lights up art show

Paper-made furniture lights up art show

Robots kick off football match in Hefei

Robots kick off football match in Hefei

Aerobatic team prepare for Aviation Convention

Aerobatic team prepare for Aviation Convention

China Suzhou Electronic Manufacturer Exposition kicks off

China Suzhou Electronic Manufacturer Exposition kicks off

'Squid beauty' and her profitable BBQ store

'Squid beauty' and her profitable BBQ store

A day in the life of a car model

A day in the life of a car model

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing