|

|

|

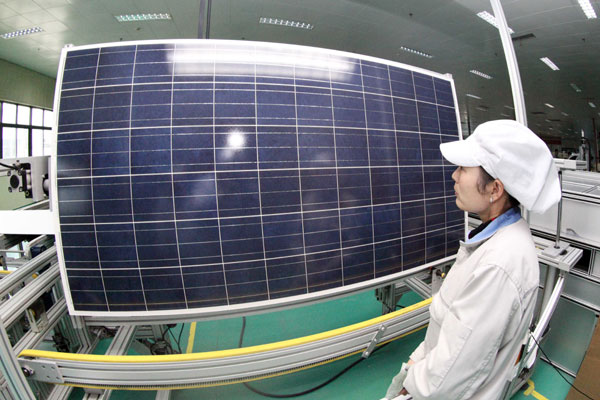

A technician inspects photovoltaic products for export at a company in Lianyungang, Jiangsu province. A Pew Charitable Trusts report has called on China and the United States to cooperate in the new-energy sector to benefit the two nations' economies. [Photo/China Daily]? |

China, US' clean energy trade worth $8.5b in 2011, report says

The United States enjoyed a $1.6 billion trade surplus in clean energy trade with China in 2011, showing that US companies still hold an absolute advantage over their Chinese counterparts, according to a report released by the Pew Charitable Trusts on Wednesday.

The two countries traded more than $8.5 billion worth of clean energy goods and services in 2011, the last year for which data are available.

"There is competition but also collaboration among China and the US. It would be beneficial for both countries to collaborate on clean energy," Phyllis Cuttino, director of Pew's clean energy program, told China Daily.

The report includes three major clean energy sectors, solar, wind and energy smart technologies. Solar energy accounts for 56 percent and energy smart technologies account for 35 percent of the surplus in the three sectors.

In 2012, the main factor was that there were fewer imports of solar panels from China, while there were more products from countries such as South Korea, Japan and Malaysia, said Nathaniel Bullard, clean energy and China analyst for Bloomberg New Energy Finance, which compiled data for the report.

The weak currency and slumping market demand also had an impact, he said.

"If the price is going down, the value is going down naturally, the volume is going down as well, because of the trade cases," he said.

Tensions between China and the US in the new energy sector in recent years and several high-profile trade cases have led to a misunderstanding that China has become a dominant supplier in this sector.

In October, the US Commerce Department set anti-dumping duties ranging from 18.32 to 249.96 percent on solar-energy cells imported from China.

In December, the US Commerce Department set final anti-dumping duties ranging from 44.99 to 70.63 percent on utility-scale towers made in China.

Ren Dongming, deputy director of the center for renewable energy development, under the National Development and Reform Commission, said China's clean energy imports shrank considerably in 2012 and were largely affected by the trade cases.

"The year 2012 was the most difficult year for Chinese solar companies. Most of them shut down, only a few survived, but are still struggling," said Ren.

"The costs of China's solar products and components have been greatly increased, and that has also hurt US manufacturers' interests," Ren said.

The two countries traded more than $6.5 billion worth of products in the solar sector in 2011, and the US had a $913 million surplus in this sector.

More than $923 million worth of wind energy goods and services were exchanged between the two countries in 2011 in the wind energy sector and the US firms held a net trade surplus of more than $146 million.

In the energy smart technology sector, which includes smart meters, light emitting diodes, advanced lithium-ion batteries and electric vehicles, the US enjoyed a net trade surplus of $571 million.

The data showed that China's clean energy industry has an advantage in large-scale manufacturing and high-volume assembly of certain clean energy products such as solar modules and LED fixtures.

"Policy choices, not China's exports, will determine the direction of the US clean energy industry in the months and years ahead," the report said.

The uncertainties surrounding US clean energy policies are likely to have the greatest impact on domestic manufacturing in the clean energy industry, Cuttino said.

Some industrial insiders said the US needs an energy policy that can attract investment.

"China has very strong renewable energy targets for wind and solar. The countries that really attract large private finance or have high growth investment are the ones with stable energy policies," Cuttino said.

lanlan@chinadaily.com.cn

4th World Internet Conference concludes

4th World Internet Conference concludes

Starbucks Reserve Roastery set to open in Shanghai

Starbucks Reserve Roastery set to open in Shanghai

Smile to get discounts in Tmall's unmanned supermart

Smile to get discounts in Tmall's unmanned supermart

Top 10 richest Chinese women in 2017

Top 10 richest Chinese women in 2017

World leading internet sci-tech achievements released in Wuzhen

World leading internet sci-tech achievements released in Wuzhen

Top tech CEOs take to the stage as Wuzhen Summit opens

Top tech CEOs take to the stage as Wuzhen Summit opens

Major topics at 4th World Internet Conference

Major topics at 4th World Internet Conference

'Made in China' dinosaurs amuse the world

'Made in China' dinosaurs amuse the world