|

|

|

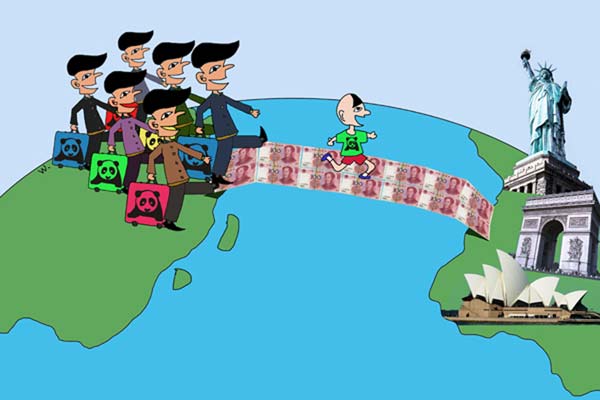

Many rich Chinese people are seeking to emigrate overseas. Data from the US Citizenship and Immigration Services suggest that 41 percent of all visa recipients in 2011 were Chinese nationals. [Photo / Provided to China Daily] |

Re-launched US visa plan lowers cash threshold for potential China migrants

As options to the lackluster stock market or the strictly contained property sector, China's expanding middle class is looking to other sources of investment in the hope of getting a profitable return, not just financially but psychologically.

While it may seem odd to encourage investing abroad in a Chinese newspaper headline, an American immigration plan has been re-launched with a lower threshold for would-be immigrant investors who want to improve on an already decent life in China.

The EB-5, a US Immigrant Investor program that offers temporary visas to foreign investors with the possibility of becoming permanent residents, has really taken off in the past three years because of a major change in the rules.

Paradoxically, the revelation of an investment fraud under the policy in January has garnered the program more attention, accompanied, naturally, by growing concerns.

The EB-5 requires foreign investors to pour $1 million into creating projects and jobs in targeted employment areas in the United States. Data from the US Citizenship and Immigration Services suggest that 41 percent of all visa recipients in 2011 were Chinese nationals.

An eligible candidate can be anyone who put his or her lawfully gained assets into an investment. However, a permanent green card is only granted if it leads to the creation of 10 or more full-time jobs.

The program did not take off after regional centers were set up 10 years ago, said Laura Reiff, co-chair of business immigration and compliance practice at Miami-headquartered law firm Greenberg Traurig LLP.

"The program was announced in the early 1990s when the (US) Congress passed the law to attract investors to compete with big migration nations such as Australia and Canada. But not many people want to invest $1 million without knowing for sure they can create jobs," she said.

In 2003, an amendment was passed to the law to set up regional centers that allowed individual investors to put their money together to create bigger and more feasible projects.

A regional center is not merely a defined geographic area but rather is a legally established entity that coordinates foreign investment within that area in compliance with the EB-5 statutory, regulatory and precedent decision framework.

Reiff said regional centers are designated by the federal government in terms of geographic areas, allowing them to manage and market projects such as hotels manufacturing facilities, nursing houses and so on. These "quasi-government" agencies interact with the US government and investors on behalf of the projects, but most of them are privately run.

The reform gained added momentum when the benchmark investment amount was cut in half to $500,000, on the premise that the investment is made either in rural areas or in districts with high unemployment rates (considered to be 150 percent of the national average or more).

4th World Internet Conference concludes

4th World Internet Conference concludes

Starbucks Reserve Roastery set to open in Shanghai

Starbucks Reserve Roastery set to open in Shanghai

Smile to get discounts in Tmall's unmanned supermart

Smile to get discounts in Tmall's unmanned supermart

Top 10 richest Chinese women in 2017

Top 10 richest Chinese women in 2017

World leading internet sci-tech achievements released in Wuzhen

World leading internet sci-tech achievements released in Wuzhen

Top tech CEOs take to the stage as Wuzhen Summit opens

Top tech CEOs take to the stage as Wuzhen Summit opens

Major topics at 4th World Internet Conference

Major topics at 4th World Internet Conference

'Made in China' dinosaurs amuse the world

'Made in China' dinosaurs amuse the world