BEIJING -- Chinese economists have urged banks to be innovative in lending to capital-thirsty small firms to help them weather the economic downturn.

Banks and policy makers should make innovations to address the difficulties small firms always meet in raising capital because of inadequate guarantees, prominent economist Cheng Siwei said on Monday during a forum on small firms' development.

|

|

He advised banks to consider whether they could "allow small firms to pledge their receivables or orders as securities for loans."

Li Zibin, president of the Chinese Small and Medium-Sized Enterprise Association, said patent technology should be accepted for small firms to get the loans they so badly need in their start-up period, a practice used in some other countries.

"But it is hard to realize," he admitted, "unless corresponding rating agencies are established in advance."

Forum delegates said that the country's burgeoning number of private banks and Internet financial institutions can also give a hand to small enterprises.

There are around 11.7 million small firms in China, almost 77 percent of the country's total companies. They contribute 60 percent of GDP, pay half of the nation's tax bill and provide over 70 percent of new jobs.

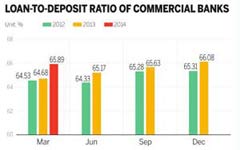

However, banks are reluctant to lend to small firms, which, suffering from high risks and operation costs, are vulnerable to economic change.

The central government has already stepped in to help with tax breaks and financial aids. The latest move came from the central bank, which cut the reserve requirement ratio for banks lending to small firms.

"Thanks to efforts from the government and banks since 2009... the situation is looking up," but financing for small firms is complicated and will remain a social focus in the next five to 10 years, Li said.