Euro debt crisis 'creates opportunities'

Updated: 2012-02-09 07:22

By Ding Qingfen and Li Jiabao (China Daily)

|

|||||||||||

With the nation having become a leading world manufacturer, many Chinese industries - including machinery and vehicles - have achieved global competitiveness, and it is an opportune time for them to venture into Europe, where many companies are starved for money, Sun said.

During the past year, as the European debt crisis escalated, there have been many high-level calls from the continent, including France and Germany, welcoming Chinese investment.

During a visit to China last week, German Chancellor Angela Merkel said: "Germany is a country that is open to all. We warmly welcome investment from China."

Premier Wen Jiabao said during Merkel's visit that China would consider how to get "more deeply involved" in resolving Europe's debt crisis.

"European nations now welcome Chinese investment and they are usually relaxed about transferring technology to Chinese companies. The general picture is comparatively favorable," Sun said.

The EU is China's largest trading partner and largest export market. The region is also a major source of high-technology transfers to Chinese companies.

Mei Xinyu, a senior researcher at the Ministry of Commerce's Chinese Academy of International Trade and Economic Cooperation, said: "We could see the debt crisis as (providing favorable) buying opportunities."

"European nations used to impose restrictions on Chinese investors, but they changed their stance and began to reach out during the past two years," he said.

Wealth funds have joined the wave of investment. China Investment Corp, the country's main sovereign wealth fund, said late last year that it planned to invest in obsolete infrastructure in the United Kingdom through partnerships.

The China-EU Summit is scheduled to be held next week, and high-level officials will discuss many topics, including how to strengthen bilateral investment.

During his meeting with Merkel last week, Wen said China expected all sorts of its companies could invest more in Germany. But Wen emphasized this didn't mean that China wanted to "buy Europe".

Fledgling stage

"The global economic gloom will push up Chinese investment abroad through mergers and acquisitions," said Sun.

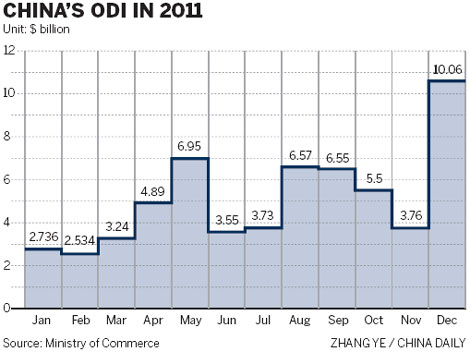

By the end of 2011, China's cumulative ODI had reached $322 billion, and 70 percent of that sum had gone to the Asia-Pacific region.

China surpassed the United Kingdom and Japan as the fifth-largest investing nation worldwide in 2010.

"The growth momentum is robust, but China's ODI is still at a fledgling stage," said Sun.

"Chinese companies don't lack money, but they are eager to enhance their brands, improve their technology and expand their sales networks."

Hot Topics

Kim Jong-il, Mengniu, train crash probe, Vaclav Havel, New Year, coast guard death, Internet security, Mekong River, Strait of Hormuz, economic work conference

Editor's Picks

|

|

|

|

|

|