Stock woes spur demand for index futures

This week's two-day plunge on the mainland stock market rudely awakened investors to the fact that share prices can go up as well as down. As uncertainties continue, investors are asking where is the much-promised index futures market.

Although not everyone agrees index futures are the remedy for stock market woes, investors are keen for a hedging mechanism to lock in earlier gains. And there's no shortage of savvy investors waiting for the chance to profit from a bear market by shorting index futures.

Economists and analysts said the latest A-share market drop triggered by global financial market uncertainties has put the mainland's first index futures into the spotlight.

But analysts warn of speculative activities, which could magnify market risks in the initial stage of the financial futures market.

Zuo Xiaolei, chief economist at China Galaxy Securities Co in Beijing, told China Daily: "In a less mature financial market, investors should be educated to first use index futures as a hedging tool to stabilize stock market movement, rather than making a profit by speculating.

"An index futures market is not a safe haven for risk-averse investors. But if used well, index futures can be a most effective tool for risk management."

Most mainland institutional investors will welcome index futures, said Lin Dongqing, director of investment at First-Trust Fund Management Co in Shanghai.

"By using this hedging tool, we can reduce earnings volatility and lock up our profit without changing the investment portfolio's constitution," Lin said.

The hedging function of index futures is of particular significance for investors with longer-term stocks, said Zhou Liang, head of research at Lipper China.

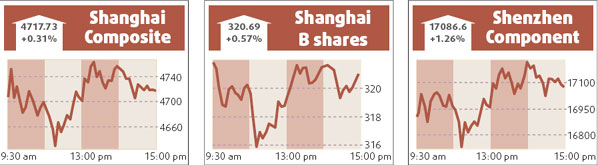

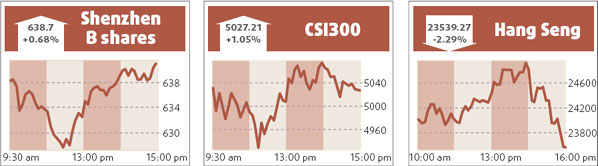

Mainland stocks continued their recovery yesterday, with the benchmark Shanghai Composite Index rising 0.31 percent or 14.69 points to close at 4717.73. Turnover on the Shanghai bourse was 150.7 billion yuan.

The key index has regained a combined 3.45 percent after Tuesday's dive. The smaller Shenzhen Component Index climbed 1.26 percent or 212.29 points to close at 17086.6 yesterday. Turnover on the Shenzhen bourse was 77.7 billion yuan.

(China Daily 01/25/2008 page15)