Overseas properties a hit among middle class

Updated: 2016-02-18 08:26

By Chai Hua in Shenzhen(HK Edition)

|

|||||||||

The Chinese mainland's middle class, including professionals, are finding overseas properties increasingly attractive, justified partly by skyrocketing real-estate prices at home.

Anthony You, a professional accountant in Shenzhen, settled for a 55-square-meter apartment in a coastal community in suburban Sydney, Australia, in 2014 for A$500,000 ($357,000).

"My property in Sydney is coming on very well at the moment," said You after having made a revaluation of the apartment recently.

He reckons the investment should now fetch him a "decent amount" with a 22-percent capital appreciation.

Combined capital city home values in Australia had risen by 8.7 percent over the 12 months to November 2015, according to Australia-based property data analysis company CoreLogic RP Data.

Huang Yiyun, a senior manager for international property services at Colliers International, said there has been a boom in overseas property investments in recent years.

She told China Daily the main aims of mainland investors in snapping up overseas real estate are immigration, studies and assets allocation, with the US, Australia, Canada and the UK being their favorite choices.

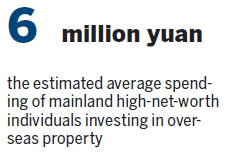

According to research by online real-estate agency SouFun International, more than 43 percent of high-net-worth individuals will buy overseas properties for asset allocation purposes, with average spending reaching 6 million yuan ($920,000).

You said rental yields from residential properties on the Chinese mainland are relatively low in general, but Australian properties offer a very stable rental income.

He said his rental income in the past two years had basically covered his mortgage and property-management costs.

Huang agreed that rental yields from overseas properties are higher than those of the mainland, which is only about 2 percent.

Besides, the high leverage offered by foreign banks, which can go up to 80 percent, is also a major factor favoring overseas property investment.

Having studied in Australia for six years, You is familiar with and trust the country's property market. His only worry is the potential fluctuation in the mortgage interest rates, but still thinks that, compared with Shenzhen's real-estate market, the risks are lower.

"I'm cautious that property prices in Shenzhen have gone up so much, but I still intend to look for an apartment in Shenzhen for my own use," he said.

Prices of new apartments in Shenzhen soared 52 percent last year and are projected to rise a further 10 to 15 percent in 2016.

Some Shenzhen property agencies are already reaching out to hot investment regions, such as the US, Australia and the Middle East.

Last year, Shenzhen-based Qfang.com teamed up with DAMAC Properties - one of the largest luxury-home developers in the United Arab Emirates - to market properties in other countries.

grace@chinadailyhk.com

(HK Edition 02/18/2016 page9)