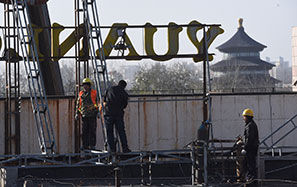

Alibaba 'close to buying stake'

|

|

$7b move may lead to initial public offering by Internet firm

Alibaba Group Holding Ltd is near an agreement to buy back a 20 percent stake in itself from Yahoo! Inc for about $7 billion, said a person with knowledge of the matter.

The purchase paves the way for Alibaba, China's largest e-commerce provider, to pursue an initial public offering in the next 18 months, said the person, who asked not to be identified because the matter is private. Alibaba, helped by shareholders Temasek Holdings Pte, Digital Sky Technologies and Silver Lake, plans to finance the purchase with cash and debt, the person said.

Alibaba has been trying to buy back the stake in itself for more than a year and stepped up efforts in September, when the US company fired former chief executive officer Carol Bartz. Reducing the Alibaba stake lessens the toehold of Yahoo! in China, the world's largest Internet market, while also making a takeover of the US company more likely, said Jordan Rohan, an analyst at Stifel Nicolaus & Co.

"For Yahoo! shareholders, the sale and subsequent march toward an IPO is a clear positive, as many questioned whether Yahoo! would be able to monetize its China assets at all," Rohan said in a research report. "In addition, the capital required to take Yahoo! private is reduced with each Alibaba monetization event."

Yahoo! has come close to selling the stake in the past and failed and a deal may be postponed, the person said. Yahoo! currently owns a 40 percent stake in Alibaba so the current proposal under discussion would cut that holding in half.

The companies struggled to make headway on negotiations under Bartz, who failed to reach an agreement to let Alibaba Group buy back shares in 2010. Yahoo! acquired the stake in 2005 in exchange for $1 billion and ownership of the Chinese unit of Yahoo!

Fissures became public by January 2010 when Alibaba Group described as "reckless" the support of Yahoo! for Google Inc, which tangled with Chinese authorities over the nation's Web-censorship rules.

In May of last year, a rift between Yahoo! and Alibaba widened after the Web portal said the Chinese company spun off its online payment business without informing shareholders. Yahoo! said it wasn't consulted about the transfer of the Alipay unit to a company mostly owned by Jack Ma, chief executive officer of Alibaba Group.

Yahoo! had a board meeting to review the transaction and will consider a dividend payment, AllThingsD reported on May 17. The website said the deal is likely to value the portion of holdings of Yahoo! at about $7 billion, or 20 percent of Alibaba's $35 billion enterprise valuation. After a potential IPO, Yahoo! could sell more of its stake, AllThingsD reported.

Dana Lengkeek, a spokeswoman for Yahoo!, declined to comment. John Spelich, a spokesman for Alibaba, couldn't immediately be reached for comment outside of regular business hours.

Yahoo!, which failed to keep pace with growth at Google and Facebook Inc, is pursuing active discussions with the Chinese company, Scott Thompson, who succeeded Bartz before stepping down this month, said in April.

Yahoo! had also been in discussions about selling its stake in Yahoo! Japan to Tokyo-based Softbank Corp, another person said. Those talks have gone cold over price and have not resumed, said the person.

Bloomberg News in New York