Banking shares due to bounce back: Goldman Sachs

China's banking shares are set to rebound sharply as recent pro-growth policies perk up demand for credit, said Goldman Sachs.

The price of Chinese banking shares has remained depressed this year despite lenders' impressive earnings.

The banking sector's price-to-earnings ratio in the A-share market is around six, only about half of the market average, as many investors believe Chinese banks' profitability will be hurt by slowing economic growth, which dipped to a three-year low in the first quarter.

The share prices of China's four biggest banks, Agricultural Bank of China Ltd, Industrial & Commercial Bank of China Ltd, Bank of China Ltd and Construction Bank of China Corp, have dropped about 20 percent over the past three months.

"We believe the current near-trough valuation of China banks has overly discounted near-term macro downside risks, and expect a rebound in share prices on cyclical macro recovery," Ning Ma and Bowei Cheng, analysts at Goldman Sachs, wrote in a research note.

They rate a buy for ICBC, BOC and ABC, with a 12-month price target of HK$7 ($0.90) for ICBC, HK$4.20 for BOC, and HK$4.90 for ABC. The targets are 40 to 50 percent higher than their price on Friday.

But Goldman Sachs' comments seem to contradict its actions. In April, the investment bank sold $2.3 billion worth of ICBC shares to Temasek Holdings, Singapore's state investment firm.

The sale was priced at HK$5.05 a share, 28 percent lower than the HK$7 target. Goldman Sachs now has a 1.2 percent stake in ICBC, down from 4.9 percent in 2006.

ICBC traded at HK$4.72 in Hong Kong at 3pm on Friday, while ABC stood at HK$3.12 and BOC's share price was HK$3.

Ma and Cheng wrote that the government's move to support growth will boost demand for credit.

The new loans, mainly borrowed by infrastructure and industrial fixed-asset investment projects, will help the country achieve its new loan target of 8 trillion yuan ($1.27 trillion) this year.

China started extending easy credit to build more roads and airports, and subsidize consumer purchases, after the economy grew just 8.1 percent in the fist quarter. The figure was a sharp drop from the 8.9 percent growth in the fourth quarter of last year and also the fifth consecutive quarterly fall.

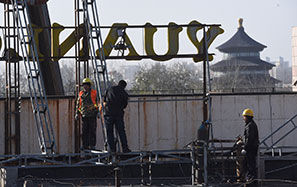

The National Development and Reform Commission, China's top economic planning agency, has approved scores of major new infrastructure projects since the start of April. These include hydropower stations, four new airports and the renovation or expansion of three big steel mills.

In another sign that shows banking shares' valuations are low, Shanghai- and Hong Kong-listed China Merchants Bank said recently that it might repurchase its shares from the stock market. No banks have ever repurchased shares in the A-share market before. A public company typically repurchases its shares when it has plenty of cash and thinks its shares are favorably valued.

Many lenders' price-to-book ratios are nearing one, meaning that investors are able to buy the banks' assets at its book value. A P/B ratio below one is more frequently seen among junk stocks.

gaochangxin@chinadaily.com.cn