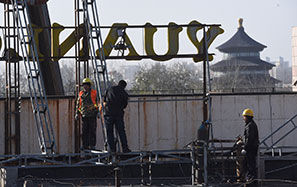

Online retailer to list stock in New York

Beijing-based online retailer LightInTheBox Holding Co, may become the first Chinese company to list its stock on a US exchange this year.

The company filed a registration with the US Securities and Exchange Commission on Thursday for an initial public offering of up to $86.3 million in American depositary shares. LightInTheBox plans to list the shares on the New York Stock Exchange under the symbol LITB.

Founded in 2007, the company offers a variety of products including clothes, electronics and toys that are sold at deep discounts and shipped from China-based suppliers to customers in over 200 countries. Its website has pages in 17 languages.

The lead underwriters of the IPO are Credit Suisse and Stifel Financial Corp, with secondary input from Pacific Crest Securities and Oppenheimer & Co.

LightInTheBox isn't widely known in China, but it ranked No 1 in revenue generated from customers outside the country among all China-based retail websites that source products from third-party manufacturers, the company said, citing a report it commissioned from the firm iResearch.

The retailer has grown significantly since inception. According to its IPO prospectus filed with the SEC, revenue grew from $6.3 million in 2008 to $200 million in 2012. Gross margin last year was 41.8 percent while a net loss totaled $2.3 million, down from $25 million in 2011.

Two venture capital firms, Ceyuan and GSR Ventures, own a little more than 40 percent of LightInTheBox, the prospectus said. As of Dec 31, 2012, the company had more than 205,000 product listings. The number of its customers increased to 2.5 million.

Only two China-based companies had IPOs in the US last year - online retailer Vipshop Holdings Ltd and social-gaming operator YY Inc, which listed its shares in November. The relative paucity after more than a dozen IPOs in 2011 was due in part by concerns over accounting practices of some Chinese companies with US stock listings.

Many US investors are believed to be interested in companies from China, given the country's still-strong economic growth.