China, US agree to share audit details

China's securities watchdog announced on Friday that a memorandum of understanding has been signed with the United States on the sharing of audit details on Chinese companies listed in the US, in a move aimed at cracking down on illegal listing and trading activities.

China Securities Regulatory Commission said the MOU was signed by the commission, Ministry of Finance and the US audit regulator, the Public Company Accounting Oversight Board.

The Chinese will offer audit details of Chinese companies listed on US markets to their US counterparts, based on Chinese law and regulations, said a CSRC spokesman.

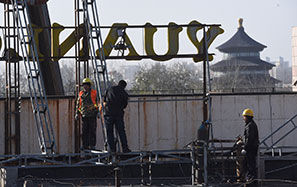

The China affiliates of five accounting firms - Deloitte, KPMG, Pricewaterhouse-Coopers, and Ernst & Young - were charged by US market regulators in December with violating securities laws for refusing to provide audit data related to investigations into some China-based, but US-listed companies.

But some of the firms said that despite assisting with the probes they were caught in legal differences between the world's two largest economies and that turning over the papers would put them in violation of Chinese laws.

The CSRC spokesman said the audit cooperation would help Chinese companies clarify facts, and raise future funds on overseas markets more smoothly.

The CSRC and the Ministry of Finance said they remained to be committed to cracking down on illegal activities and maintaining the integrity of the market, while positively seeking cooperation with overseas regulators on the healthy development of the global capital market.

Under the agreement, the PCAOB will be able to share documents with the US Securities and Exchange Commission, but only if they were obtained through a PCAOB enforcement action.

China has previously expressed concern over exposing nationally sensitive corporate information, raising fears that China-based auditors would be deregistered by the PCAOB.

Nie Lei, a partner at PwC China, told China Daily that offering audit details will make US investors realize that Chinese companies are confident about going abroad to get listed.

"Quality companies are not afraid of offering their core information, and it is a good way to screen companies against financial fraud," said Nie.

Zhang Yifan, a hedge fund analyst who requested his company name be withheld, added: "This cooperation between China and the US is a good thing, and a compromise for both sides."

Zhang said most companies listing in the US through IPO are solid, and any with problems are normally those who seek a listing through the back-door, using small accounting firms.