June PMI signals weakness

|

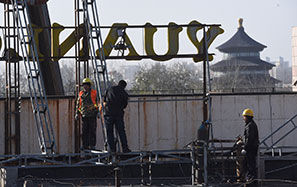

A worker assembles a tunneling machine at a China Railway Equipment Manufacturing Co Ltd plant in Zhengzhou, Henan province. Deteriorating external demand and moderating domestic demand have dragged down the country's factory activities in May, according to HSBC. Zhang Yupeng / For China Daily |

Slack external and domestic demand blamed

China's manufacturing production may have dropped to a nine-month low in June, adding further headwinds to the country's economic progress in the second half of this year, figures from HSBC said on Thursday.

The flash estimate of the HSBC China Purchasing Managers' Index fell to 48.3, worse than the final reading of 49.2 in May. It is also the third consecutive monthly decline and hitting its weakest level since September, according to HSBC Holdings PLC.

A reading below 50 signals contraction.

The reduction means an accelerated contraction of the country's manufacturing sector, economists said.

Qu Hongbin, HSBC's chief economist in China and the co-head of Asian Economic Research at the bank, blamed deteriorating external demand, moderating domestic demand and rising destocking pressures for dragging down the latest reading.

In June, manufacturing output showed by a sub-index of PMI retreated to an eight-month low of 48.8, down from 50.7 in May.

New orders shrank at the fastest speed in 10 months, suggested by a reading of 47.1, compared with 48.7 a month earlier.

The HSBC figures also showed that in June, the PMI sub-index of employment continued to fall, to 47.9 from 48.6 in May, the lowest level in 10 months, and marking a fifth consecutive monthly drop.

Zheng Shili, general manager of Wenzhou Golden Emperor Shoes Co Ltd in Zhejiang province, said that most shoe manufacturers in the city were struggling to make a profit.

"Overseas orders have continued to decline as consumer demand remains severely affected by the slow economic recovery in most European countries," said Zheng.

Orders for leather shoes dropped about 30 percent in May compared to the same period two years ago.

Liu Qian, deputy director of China Service at the Economist Intelligence Unit, a think tank under the Economist Group, said: "It seems unlikely we will see manufacturing production pick up this year."

Tighter financing and concerns about property price bubbles have slowed investment in the manufacturing sector, and it remains unlikely that policymakers will loosen monetary policy in the short term, Liu added.

Qu said he expected the government to focus on reforms rather than stimulating growth.

As reform measures have a limited impact in the short term, HSBC is expecting slightly weaker growth in the second quarter, Qu said.

HSBC lowered its annual GDP prediction for 2013 on Wednesday to 7.4 percent from its previous 8.2 percent.

According to the National Bureau of Statistics, industry output, fixed-asset investment and cross-border trade all weakened in May.

The NBS is expected to announce official PMI figures on July 1.

In the first three months of the year, GDP growth slowed to 7.7 percent from 7.9 percent in the fourth quarter of 2012.

Louis Kuijs, chief economist in China with RBS PLC, said: "Policymakers would want to see this weakness confirmed by the official PMI and other hard activity data before taking any bold decisions".

He added that the slower growth data will test the government's resolve to maintain its current macro policy stance.

The State Council has called for financial reform "in an orderly way" to better serve the country's economic restructuring, while maintaining a prudent monetary policy.

Kuijs said that policymakers were likely to be able to maintain that line "as long as economic growth is expected to stay above 7 percent and the labor market holds up reasonably well".

"The People's Bank of China's policy stance amid the current tightness of liquidity on interbank markets is in line with that paradigm."