Behind stock slump

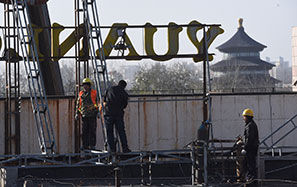

China's stock market suffered its biggest daily loss in nearly four years on Monday, showing investors' uncertainty over the country's economic prospects and policymaker's intentions.

While the benchmark Shanghai Composite Index slumped by a rare 5.3 percent, financial stocks dropped more than 7 percent following the statement by the People's Bank of China, the central bank, that commercial banks need to do a better job managing their capital and lending activities.

The market has obviously interpreted the central bank's statement as a signal of credit market tightening. Such an interpretation is not groundless, because it will be adding fuel to the fire if the central bank maintains its hands-off approach to shadow banking and other credit problems.

The shadow banking problem, together with local government debts and surging property prices, constitutes substantial risks for the country's financial stability. If the authorities continue to pursue a high nominal economic growth rate built on easy credit expansion those problems could get worse and have an unaffordable impact.

It is still too early to conclude that the monetary authorities will sit idle as the money market becomes tight and the stock market becomes more bearish. But policymakers have brought home the message that the past mode of economic growth driven by credit-based investment should no longer continue.

After three decades of fast economic expansion, further rapid economic growth based on short-term credit stimulus would be both unsustainable and dangerous.

The high price of housing, the growing local government debts, the sluggish private sector and, most recently, the tight money conditions of banks, all point to the risks of an overstretched economy if we do not accelerate the overdue structural reforms.

Monday's falling stock exchange adds to the signs that the authorities are preparing to continue the painful but necessary reform agenda to keep the economy rolling in a more sustainable manner.

The authorities may fine-tune their policies so that they can be more acceptable to the market and reduce short-term stress as a result of the restructuring. The direction of reform, however, cannot be clearer.

A problem-solving philosophy, which exposes problems for early treatment, is more advisable than a tinkering method that only delays a crisis.

Of course, it is very challenging to pre-empt any crisis, and the authorities must closely monitor market reactions to prevent their policies from having undesired results.

(China Daily 06/25/2013 page8)