Bungled new IPO rules result in red faces

Stocks | Ed Zhang

At some of the investors' conferences taking place in Beijing and Shanghai this month, one could notice the frustration and anger of young Chinese reporters over the state of the domestic stock market.

Participants in those conferences were primarily institutional investors from around the world. They were here not to deal with the domestic stock market, in which they had little interest, but in the China concept and in Chinese companies listed overseas.

But for the Chinese journalists, it was almost embarrassing to see their recently rekindled hope for a good rise in the domestic stock market once again fizzle out, when the capital markets in the United States, Europe and Japan are almost certain to climb.

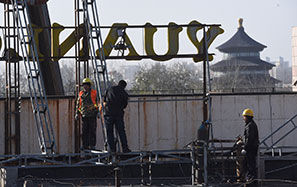

In December, when the China Securities Regulatory Commission declared that it had some new listing rules and was preparing to lift a 13-month ban on IPOs, columns in the Chinese media welcomed the move, in the belief that it would render better protection for small investors and, in due course, mend the reputation of the Chinese capital market after its continual underperformance in serving the world's fastest growing economy.

The floodgates shut again before the water arrived. The CSRC hastened to halt the listing of a number of companies in the first batch of planned IPOs after discovering some gaping holes in the new listing rules.

Worst of all, there were no rules and penalties for a company that sets its share offering price at the highest possible level only to facilitate its founding shareholders' quick cash-out, which, in practice, often suggests the abandoning of their responsibility for the company's future performance.

According to the listing plan of one company, its founding shareholders would get away with nearly 60 percent of the total proceeds. That would be only half a step away from open robbery. And judging from the amount of public money involved - 3.2 billion yuan ($529 million) in this particular case - its potential harm would be equivalent to political corruption.

The market was immediately filled with fury over the ugly greed on the part of the company and its insiders. Thus, uproar and protest.

Furious, too, was Xiao Gang, the CSRC chairman, the financial information website caijing.com.cn reported on Jan 14. Xiao ordered his staff to come up with effective ways to salvage the sinking market confidence. But before the CSRC can do that, the domestic stock market will remain an investors' eyesore, last week's tumbling Shanghai Composite Index being proof. Despite the frustration and anger of China's young reporters, the flip-flop in the domestic stock market and the hasty fumbling of the CSRC's "visible hand" have a positive side. It means that Chinese regulators and, primarily, Xiao, the CSRC chairman, are beginning to learn some important lessons.

Being a professional regulator, Xiao's job is different from many of his counterparts as directors of this or that ministry. His job is not to "take care of" a system like the traditional patriarchal leader of a clan, but to apply equal, and equally stern, rules to all participants - in this case, in a public market where a tremendous amount of people's money is at stake.

At times, Xiao's logic will be different from that of his boss, Li Keqiang, the Chinese premier. While Li's emphasis is to streamline the government, and in practice, to exit or relegate some functions, Xiao's should be to never give in on the bottom line of law and reason. He should act as a police officer to fight against and deter all attempts to steal public money.

And from the clearly inadequate preparatory work that the CSRC staff did for the re-opening of domestic IPOs, Xiao should become suspicious, as every competent police chief would, about some insiders conspiring with outside interest groups.

At least he should convince himself that any public office employee, with a minimum level of common sense, would not have left such obvious holes in his or her work as to set up the boss as a target for widespread public criticism. Xiao should start an internal reshuffle in the CSRC and look for new lieutenants. And in a time of rapid reform, he really can't afford to wait.

The author is editor-at-large of China Daily. Contact the writer at edzhang@chinadaily.com.cn.