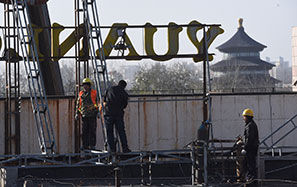

Top builder Vanke gives thumbs up to property tax legislation

Property tax legislation will be positive for the whole sector, said Yu Liang, president of China Vanke Co, the largest property developer in China.

"Reform in property tax is inevitable. It will affect the whole industry in a positive way," said Yu on Thursday, adding the company will actively participate in the construction of government-subsidized housing.

Lee Wee Liat, head of financials and property research with BNP Paribas SA, said the property tax will not rein in property prices because it is mainly aimed at speculative demand.

"As a long-term mechanism, a property tax will give another income channel to local governments, which are used to relying too much on land sales for revenue," he said.

Premier Li Keqiang said in his annual policy speech on Wednesday that China will proceed with property tax legislation and will begin to build more than 7 million government-subsidized homes.

It is also the first time property curbs were not mentioned in the annual policy speech.

Vanke posted annual revenue of 127.45 billion yuan ($20.84 billion), up by 31.6 percent from 2012.

It had a sales area of 14.9 million square meters in 2013, totaling 170.94 billion yuan in value, representing increases of 15 percent and 21 percent respectively.

The company expanded to overseas markets, including the US and Singapore, in 2013.

In February, the company teamed up with US developers RFR Holding and Hines LLC on a high-end residential project in New York.

Yu said that internationalization is one of the long-term strategies for Vanke, adding the company will continue to search for potential opportunities this year.

The company had sales of 40 billion yuan in the first two months of this year. In February, it sold about 1 million square meters for 12.1 billion yuan, up 19.4 percent and 29.6 percent respectively from the same periods last year.

A research note from the Goldman Sachs Group Inc said China's housing supply in most cities will increase in 2014 because of weaker demand and affordability, and an economic slowdown.

Chen Xingdong, chief economist with BNP Paribas, said the risk of property prices falling will increase this year because of the cumulative effects of housing controls and the government's anti-corruption drive.

In January, the number of cities where both prices in primary and secondary markets was still rising fell by three and six, to 62 and 48 respectively, compared with December, according to the National Bureau of Statistics.