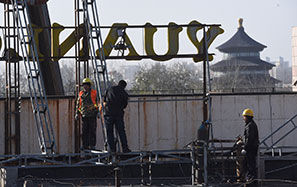

Rekindle the stock market

THE TIMING OF THE AUTHORITIES' LATEST promise on financial reforms might have made it look like a stopgap effort to boost the country's sagging stock market.

But such a blueprint for capital-market overhaul is not, and should never be, about the short-term performance of Chinese shares.

Instead, by boosting regulatory transparency and widening market access, the significance of the new reform guidelines should be evaluated by their long-term role in rendering the dysfunctional domestic stock market a really working one.

On Friday, the State Council, China's Cabinet, unveiled a series of guiding principles for reforming the country's financial markets.

At a time when the benchmark Shanghai Composite Index has been teetering on the verge of again dropping below the psychologically important threshold of 2,000 points, a piece of confidence-lifting news is certainly more than welcome.

By the end of last week the index had lost a total of 3 percent since the start of the year, following a decline of 6.8 percent for the whole of last year.

Worse, late last month, the securities regulator signaled that it was ready to reopen the floodgates of new share sales following a two-month pause, which has since weighed heavily on already fragile investor sentiment.

Under such circumstances, it is natural for investors to read too much into any policy move that sounds as positive as they expected.

Not surprisingly, China's stock market on Monday registered a 2-percent rise, the biggest gain in seven weeks, on those promises of ambitious financial reforms, in spite of the lack of details.

Indeed, the government must be eager to boost the domestic stock market, which has basically failed to work as either a barometer of the national economy or a system to reallocate market funds for greater efficiency. While the Chinese economy has led the world with the strongest recovery, the country's stock market has kept ranking among the worst worldwide.

If such a divergence between the performance of the national economy and the stock market is allowed to expand further, it is not likely that the domestic stock market will be able to play a positive role as its counterparts in many developed countries have done in supporting the growth of domestic consumption.

Therefore, more important than starting a fresh rally right now, the new guidelines, which envision a multitier capital market by 2020, should focus on preparing a highly efficient and inclusive stock market to best serve the country's ongoing transformation toward consumer-driven growth.