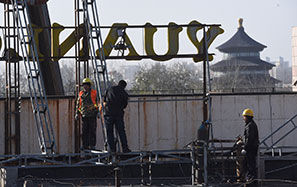

Landmark year as ODI set to exceed FDI

China's outbound direct investment will outstrip incoming foreign direct investment for the first time this year, a report on the globalization of Chinese enterprises forecast on Wednesday.

Fueled by demand for energy, construction projects and other assets to power its economy, ODI from the world's second-largest economy is likely to rise above $120 billion in 2014, according to the Center for China and Globalization, a top think tank.

China has been buying assets abroad, in particular in the energy and resources sector, but that investment model is changing as more money goes into high-technology, innovative and high added-value industries, according to the report.

China's ODI in the high-tech sector reached $6.3 billion during the first half of this year, with more than 85 percent going to the United States.

Although energy still takes the lion's share of Chinese companies' foreign investment, industries such as construction and culture experienced the fastest growth (129 percent and 102 percent, respectively) from a year earlier, the report showed.

The report highlighted another trend: private-sector enterprises have become more active in outbound investment, especially in the US, where their investments account for 76 percent of the total Chinese investment in that nation.

But while investment headed to the US grew at the fastest pace among all destinations, Asia remained the top target for Chinese investment.

Long Yongtu, former vice-minister of commerce and chairman of the think tank, said that this year will be a milestone for Chinese companies as their global footprint broadens and they become more competitive on the global stage.

"China's sustainable growth and its ability to compete on the world stage hinge upon the speed at which it can foster its own powerful international companies, and 'going out' will provide a platform for Chinese companies to grow through participation in the global economy," said Long, also secretary-general of Boao Forum.

Wang Huiyao, CCG's president and the lead author of the report, said that it is clear that China's ODI can boost international trade and thus stave off trade friction with the country's trading partners.

But he warned that Chinese companies going abroad may face financing problems, vulnerability to risks and misunderstanding of different cultures and regulations in the overseas markets.

"These are the same obstacles that foreign companies face coming into China," he said, suggesting that Chinese companies should adopt foreign expertise and fully localize their workforces by hiring more local employees.

lvchang@chinadaily.com.cn