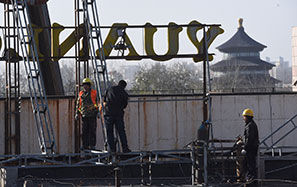

Curbs eased by leaders to boost real estate sector

The Chinese leadership has decided to ease the housing credit policy to boost the property market and to add fuel to overall economic growth.

The central bank, the People's Bank of China, cut the minimum down payment for second homes to 40 percent from 60 percent on Monday.

The bank said the policy is designed to improve the living standards of buyers who have not paid off their existing mortgage but are buying a second home.

The Ministry of Finance said in a separate statement on Monday that it is easing taxation on home sales.

Sales tax on pre-owned homes sold two years or more after purchase will be canceled, the ministry said. Since 2011, owners selling homes within five years of purchase had to pay such taxes.

Chinese property stocks surged the most in six years on speculation the government would ease real estate curbs. The Shanghai Property Index was up by 7.3 percent at the close, its biggest gain since March 2009.

The Shanghai Composite Index rallied by 2.6 percent, or 95.47, and closed at 3,786.57, marking a peak since 2008.

Yu Jingbo, vice-president of China Construction Bank, said it is researching mortgage policies, adding, "We will make progress on the issue as soon as possible."

Analysts said the new policies are the "weapons" mentioned previously by Premier Li Keqiang to stabilize growth and to ensure the persistent economic slowdown does not fall below the bottom line - which is economic growth of about 7 percent this year.

Wang Jun, a senior economist at the China Center for International Economic Exchanges, a government think tank, said, "The real estate market should remain healthy and stable, as it is still one of the strongest driving forces for the economy."

Wang said the measures had been released before the National Bureau of Statistics' first-quarter economic data reports next week.

According to the bureau, the number of cities with month-on-month price falls among the 70 tracked by the government rose in February to 66 from 64, after falling for three consecutive months.

Meanwhile, industrial output, fixed-asset investment and retail sales retreated to multiyear lows in the first two months of the year, suggesting more policy easing is needed to boost the economy.

Analysts said lowering the down payment requirement will support growing demand for better housing, benefiting the property market. For example, the down payment on a 90-square-meter apartment in central Shanghai under the previous policy was about 3.78 million yuan ($616,000). It is now 2.11 million yuan.

Regina Yang, director and head of research at Knight Frank Shanghai, said the move will further liberalize the property market and help to support homebuyers' demands for better housing conditions.

Financial institutions predict that the consumer product index, a main gauge of inflation, may continue to ease in March from 1.4 percent in February.

Contact the writers through chenjia1@chinadaily.com.cn

Jiang Xueqing contributed to this story.