Inflation bears defeated as swaps show faith in Draghi

Bond investors are speculating that euro-region inflation is near its bottom, as they look beyond four straight months of slumping consumer prices with bets that Mario Draghi's stimulus policies will work.

The European Central Bank president's quantitative-easing program has helped drive up inflation prospects from an 11-year low. Only a few months ago, Europe's protracted economic stagnation and a plunge in crude oil had investors pricing in the likelihood of little or no consumer-price gains over the next five years, with some even braced for deflation.

"There seems to be some change in attitude about inflation in Europe," said Francis Diamond, a fixed income strategist at JPMorgan Chase & Co in London. "I see a degree of positivity coming through from our inflation survey. It may not be a sea change shift, but at least it's a start of a more constructive environment for inflation in the euro region."

Optimism that the ECB's unprecedented monetary stimulus will revive price growth has prompted money flows into investments that appreciate with the cost of living. The iShares Euro Inflation Linked Government Bond pulled in a record 80 million euros ($86 million) last week. In the cash market, index-linked securities outperformed their nominal peers for the first time in the last three quarters.

Stimulus push

Draghi will be successful in heading off the threat of deflation and spurring the cost of living, according to Cosimo Marasciulo. The head of Pioneer Investment Management Ltd's European government bonds said he's also betting on it using debt-market derivatives.

"In the eurozone, you have a central bank which is still pushing hard in terms of stimulus, and that's good for inflation," Marasciulo said in an interview in Singapore. "Things are improving. What we will see in the next few quarters or so is even higher upward revisions on growth and inflation."

Five-year inflation swaps, a market gauge of the inflation outlook, rose to 1.24 percent on April 21, up from 0.38 percent in January, which was the lowest since Bloomberg began collecting the data in 2004.

A similar-maturity break-even rate for Germany, another key metric derived from the yield difference between nominal and inflation index-linked bonds, rose to 0.98 percentage points on Monday from as low as minus 0.43 percentage point in January.

Threat receding

The pace of price-growth envisaged is well below ECB's 2 percent target. Yet, it shows investors see the risk of deflation receding for the 19 euro members, whose combined economy is larger than China's and second only to the US.

Central banks have tried multiple policies to spur faster inflation after the financial crisis stalled growth and sapped demand. When prices start to fall and deflation sets in, companies may delay investment and hiring and individuals may postpone purchases because they don't feel as secure in their jobs.

The ECB embarked on its quantitative-easing program in March, pledging to pump at least 1.1 trillion euros into the euro system buying bonds through to September 2016. The Frankfurt-based institution cut interest rates twice, offered banks long-term liquidity and started buying private assets.

It may take time before the stimulus shows its benefit on growth and inflation. Consumer prices in the euro region fell 0.1 percent from a year ago in March, marking a fourth consecutive month of declines. While growth picked up in the fourth quarter, the unemployment rate at 11.3 percent is not miles away from record 12.1 percent in April 2013.

That's not holding investors back from buying inflation - linked bonds. In the cash market, the region's index-linked bonds returned 5.9 percent in the first quarter, the best performance since the three months ended June 2012, according to Bank of America Merrill Lynch Bond Indexes. Nominal bonds rose 4.3 percent.

|

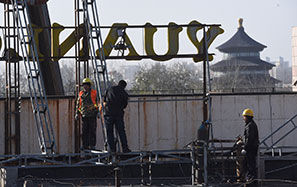

Mario Draghi, president of the European Central Bank, unveils a new 20-euro banknote at the ECB headquarters in Frankfurt, Germany, on Feb 24. Bond investors are betting that Draghi's stimulus policies will work. Martin Leissl / Bloomberg |