Crossed wires for phone firms

Demand petering out in China as handset penetration rate peaks during first quarter, according to IDC

Is Chinese buyers' appetite for smartphones slowly running out of steam? At least for the time being it appears so, after the world's largest smartphone market recorded an unprecedented shipment contraction during the first three months of the year, an industry report said on Monday.

Demand for mobile handsets is hitting ceiling in China after six years of rapid expansion, said the report published by International Data Corp, a major research firm.

|

Passengers check their smartphones on a subway train in Beijing last week. Demand for mobile handsets in China has hit the ceiling after six years of rapid expansion. Wang Jing / China Daily |

About 98.8 million devices were delivered to the Chinese mainland market from January to March, while shipments exceeded 103 million during the same period a year earlier, the IDC said. The 4.3 percent year-on-year decrease was the first since 2009, the dawn of the smartphone era.

Apple Inc, Xiaomi Corp and Huawei Technologies Co Ltd were the top three vendors in the first three months in terms of shipments. The big three vendors accounted for more than 39 million devices during the period, or for nearly 40 percent of the market share, according to IDC.

The Chinese market is also becoming increasingly saturated and the country has joined the United States, the United Kingdom and Japan as mature markets for the vendors, IDC said. China is heading to the saturation point, with nearly nine out of 10 Chinese people owning a smartphone by the end of last year, according to an earlier estimate from another consultancy Gartner Inc. The country outpaced the US as the world's No 1 smartphone market in 2011.

Antonio Wang, an IDC analyst, said the shipments may witness continuous drops over the subsequent quarters due to weak demand.

"The number of first-time buyers has slumped because the penetration rate is extremely high," Wang said, adding Apple's trade-in program, launched on the Chinese mainland in late March, will be the biggest driver of shipments in the second quarter.

Wang Yun, a 28-year-old saleswoman working for a pharmaceutical company in Beijing, uses an iPhone 6. Wang said she will not buy a new phone until next year because the current device is "good enough".

"I don't think it is wise to spend too much money on smartphones. So I only got an iPhone 6 instead of the 6 Plus," Wang said. Her device is selling for more than 5,000 yuan ($800) in China.

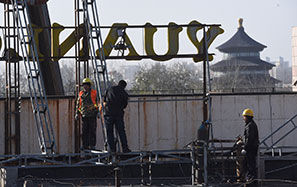

Hours after IDC warned over the shipment fall, Apple CEO Tim Cook signed up a micro-blog account on Weibo, a Twitter-like service, hoping to attract Apple fans. The account attracted about 200,000 followers in the first hour.

Apple is facing the strongest challenge in China as Xiaomi and Lenovo Group Ltd are fast encroaching into the US company's high-end user base. The two companies, along with Apple and Samsung Electronics Co, have all claimed the pole position in the IDC list during the past five quarters, another testimony that the country's smartphone market is a tangled warzone for the vendors.

With the Chinese Internet firms slated to join the battle soon, a price war is imminent.

After online video provider LeTV Holdings Co Ltd introduced its flagship devices similar to the iPhone 6 Plus but at a fraction of the price, Xiaomi and Motorola Mobility, a Lenovo subsidiary, quickly announced 300 yuan discounts on their handsets.

Local companies are focusing on mid-end users for the rest of the year and introducing more on good-quality gadgets priced below 3,000 yuan.

"The major players are all likely to lower prices for a better place in the market," according to Antonio Wang. "The leading brands are finding ways to explore emerging markets outside China, where the demand for smartphones is picking up."

India, Indonesia and the Middle East are among the biggest targets for Chinese companies like Xiaomi and Huawei.

gaoyuan@chinadaily.com.cn