Private equity firm makes a bet on innovation

Idinvest program designed to support forward-thinking companies in China and France

A European company is intent on seizing the opportunities created by China's new five-year plan which aims to sustain economic growth and double GDP and incomes by 2020 from the 2010 level.

The 13th Five-Year Plan (2016-20) will also put greater emphasis on innovation and greater international collaboration.

|

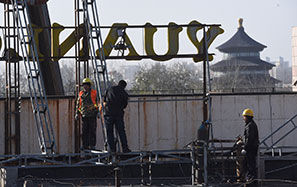

Chinese Premier Li Keqiang (standing, left) and French Prime Minister Manuel Valls witness the signing of an agreement between Christophe Baviere (front right), chairman of Idinvest Partners, and Wang Tianyi, chairman of CIIC, in Toulouse during Li's visit to France in July. Provided to China Daily |

Idinvest Partners, the Paris-based private equity firm that was founded in 1997, funds innovative small and medium-sized enterprises at all stages of development. It manages nearly 6 billion euros ($6.5 billion) in assets in France and elsewhere in Europe, according to Christophe Baviere, the company's president.

In recent years, China has ramped up collaboration with Europe as part of its Belt and Road Initiative. Baviere predicts more equity capital will flow between the two, "and while France is currently underrepresented in Chinese investments, balancing phenomena are expected in the coming years".

Idinvest has set up Chance, a China-France cross-border investment program dedicated to supporting innovative SMEs. The program signed its first investment agreement with China International Industry & Commerce Co Ltd in Toulouse in July, witnessed by Premier Li Keqiang and Prime Minister Manuel Valls.

"SMEs are key players in French innovation, accounting for 43 percent of French expenditure in research and development, featuring a strong dynamism in intellectual property. More than 18 percent of all patent applications were by French SMEs between 2012 and 2014," Baviere says.

He adds that France came third overall in a Reuters survey on the most innovative nations, behind the United States and Japan, and that many French enterprises have made Forbes' list of the world's 100 most innovative companies.

Yet while French SMEs may be among the most innovative in Europe, Baviere says China is without doubt a new land for innovation, as evidenced by a series of laws and programs to support innovative companies, such as offering tax relief to shareholders in high-tech SMEs.

The Chance program focuses on key sectors including finance, health, digital technology and the environment, which Baviere says correspond with the priorities and challenges facing China's market and government over the next decade.

"The Chinese government intends to accelerate the country's access to related technologies, either via commercial foreign agreements, technological foreign partnership or via foreign investment," he says. China is moving away from being the workshop of the world, he says, "and is turning into a huge consumer market, longing for services, technology and high-end products."

Chance has been designed to give Chinese investors access to high-quality investment vehicles and provide French SMEs access to the equity capital they need to grow internationally. Baviere believes the program will create jobs in China and France, as well as create value in China by developing solutions for major problems.

A unique aspect of the program is that it is dedicated to indirect and minority-stake Chinese investment. Looking at recent majority-stake Chinese investments in France, Baviere says: "Some acquisitions did not go as smoothly as expected. There may be a strong political and social reluctance toward Chinese takeovers, and post-merger integration is constrained."

An October report by Boston Consulting Group says global mergers and acquisitions by Chinese companies are growing at a rate of 35 percent a year ($26 billion last year), with Europe the main target. However, only 67 percent of these M&As are completed.

Baviere says this is because the best targets, technology and know-how are not for sale on the open market, and speculates that there is underlying mistrust of Chinese intentions.

The Chinese also undervalue the need for synergy, intercultural management and good labor relationships when implementing mergers, he adds.

wangmingjie@mail.chinadailyuk.com