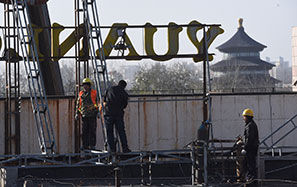

Stocks boosted on prospect of inclusion of A-shares in index

Stocks in China rallied on Tuesday as investors seemed to speculate that the country's A-shares may soon be accepted by a well-known global index provider.

The Shanghai Composite Index surged as much as 3.3 percent, closing at 2,916.62, led by financial companies. The Shenzhen Component Index rose 4 percent, while the ChiNext startup index climbed by 4.9 percent.

The sharp gains came as a report from Goldman Sachs speculated that the likelihood of global index provider MSCI adding mainland-traded Chinese stocks, or A-shares, to its investment benchmarks like the Emerging Markets Index rose to 70 percent from 50 percent.

"The change to trading suspension rules addressed one of the key concerns raised by foreign investors during the MSCI annual survey, which can be a spark to the stock market rebound," said Hong Hao, managing director at BOCOM International Ltd.

MSCI could decide to include the A shares in its benchmark indexes by June 15. Nearly one year ago, MSCI decided against including the shares due to investment restrictions.

Asset managers, pension funds, insurers and individual investors hold passive investments like an exchange-traded fund (ETF) or mutual fund that tracks an MSCI index.

Last week, China's stock exchanges published rules that restrict arbitrary trading suspensions for Chinese stocks. Trading halts will be capped at three months for major asset restructuring and one month during private placements. The bourses will have the right to reject trading-halt applications under extreme market circumstances to protect investors, Bloomberg reported.

Brendan Ahern, chief investment officer at Krane Shares, a US-based provider of China-focused ETFs, said the outright elimination of trading halts would have made inclusion a certainty. "The new rules are a step forward in minimizing the concerns investors have with halts," he said.

The Goldman report cited the revised rules on trading halts in part for raising its outlook for MSCI inclusion. However, a report from Citi research didn't improve the chances for MSCI inclusion despite the change.

Ahern said MSCI has highlighted investor concern on three issues: trading halts, beneficial ownership of on-shore stocks held by foreign investors, and required government approval to list ETFs and mutual funds that have exposure to equities on the mainland.

"Since April we have seen the beneficial ownership issue clarified, which should eliminate it as a concern. The new (trading) halt rules ease though doesn't eliminate the concern of daily liquidity providers," he said.

paulwelitzkin@chinadailyusa.com