China Life takes stake in landmark NY property

China Life Insurance Group Co, the country's largest insurer, has taken a sizable but undisclosed stake in a landmark New York office block, in a deal worth $1.65 billion.

The insurer is believed to be the largest investor in the Manhattan building, at 1285 Sixth Avenue, in a transaction led by US developer RXR Realty LLC, according to media reports.

The purchase marks the latest high-profile property move by a Chinese company, in a trend experts say is fueled by the desire to hedge against the risks of a slower Chinese economy and the yuan's depreciation.

"It's a reasonable move by China Life, given the expectation of a strong dollar and the sound economic recovery in the United States," says Grant Ji, executive director of capital markets for northern China at CBRE Group, a US commercial real estate company.

The 167,220-square-meter Sixth Avenue site houses tenants include UBS Group AG and the law firm Paul, Weiss, Rifkind, Wharton & Garrison.

Ji says trophy properties in prime locations such as New York and London are considered ideal targets for Chinese insurers, as they offer low-risk investments that generate a stable yield.

Property deal tracker Real Capital Analytics told The Wall Street Journal recently that Chinese companies have been the most-active investors in the US since the start of the year, buying 47 properties worth a combined $9.3 billion.

China Life's purchase also comes at a time when Chinese insurers have been suffering a significant decline in profits and investment returns, due to the sharp volatility of the domestic A-share market.

"More life insurance companies are interested in investing in foreign real estate to earn stable rental yields and to diversify their investment portfolio," says Sally Yim, senior vice-president at global rating agency Moody's Investors Service Inc.

"China Life's overall real estate holding is still small, so despite the illiquid nature of this kind of investment, we believe the risk is manageable."

China Life was hit by a 57.2 percent fall in net profits to 5.22 billion yuan ($794 million; 715 million euros) in the first quarter of the year. Its investment return also dropped by 4 percent to 3.7 percent during that period.

Last year, the company and its domestic rival, Ping An Insurance Co, jointly invested in a $500 million development project in Boston's Seaport District, which marked both companies' first move into the US property market.

Contact the writers at lixiang@chinadaily.com.cn and huyuanyuan@chinadaily.com.cn

|

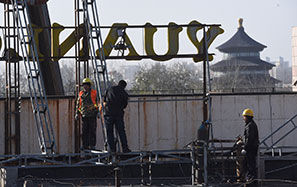

China Life Insurance Group Co is China's largest insurer. Chen Junmin / For China Daily |