Insurance market sees big potential

China set to take No 2 spot from Japan as number of policyholders and premium income rise

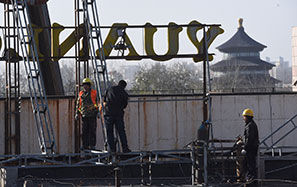

China will surpass Japan as the world's second-largest insurance market this year, boosted by surging demand from its ever-growing middle class, according to forecasts by industry insiders.

The country's premium income reached 1.9 trillion yuan ($285 billion; 252 billion euros) in the first six months, up 37.3 percent year-on-year, data from the China Insurance Regulatory Commission show.

The growth rate has accelerated from 17.5 percent in the first half of 2014 and 20 percent in the first half of 2015.

"A healthy society should not be full of stock investors but policyholders," says Jack Ma, founder and executive chairman of Alibaba Group Holding Ltd, a major stakeholder in ZhongAn Online P&C Insurance Co.

Currently, the nation has 330 million policyholders, triple the number of stock investors.

"In terms of serving the 1.3 billion population, we have too few insurance companies and products, which means there is still huge potential in the sector," Ma adds.

Alibaba holds 19.9 percent of ZhongAn, the country's first online insurance company, which was set up in 2013. Other major shareholders include Tencent Holdings Ltd and Ping An Insurance (Group) Co of China Ltd.

Liang Xinjun, vice-chairman and CEO of Fosun Group, is also optimistic about the prospects for China's insurance sector. "The country's ballooning middle class, with its ever-growing consumption power, will be the main client of insurance companies," he says.

Fosun has increased its stakes in a number of insurers.

With growing interest in the rapidly developing insurance sector, Xiang Junbo, chairman of the China Insurance Regulatory Commission, emphasizes that insurers should be risk managers rather than risk makers.

"For shareholders who just want to take advantage of insurance as a financing channel, we will seriously punish them based on laws and regulations," Xiang says.

The commission's data show that the premium income of foreign insurers in China in the first half of the year totaled 95.9 billion yuan, accounting for 5.1 percent of the total market, up from 4.38 percent last year.

Steven Lam, life insurance analyst at Bloomberg Intelligence, says China's insurance market is open, but the competition is fierce.

"Foreign insurance companies should either have financial strength or innovative capabilities to stand out in the market," Lam says, adding that expanding channels is a costly exercise.

Contact the writers through huyuanyuan@chinadaily.com.cn