Massive fund to advance reform of giant SOEs

Major Chinese state-owned enterprises have launched the nation's largest private equity fund, worth 350 billion yuan ($52.5 billion; 47 billion euros; 40 billion), to finance SOE restructuring as part of China's efforts to advance supply-side reform.

The money will be used for such measures as mergers and acquisitions, industrial upgrades and innovation, officials said. A private equity fund, in general, is a type of vehicle involving rules for capital not publicly noted on a stock exchange.

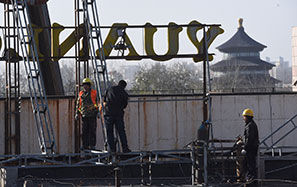

The China Structural Reform Fund was initiated by China Chengtong Holdings Group Ltd, a state-owned asset-operating company that has been involved in reorganization of SOEs. The fund will be managed by the state-owned Assets Supervision and Administration Commission.

Initial capital of 131 billion yuan was raised by 10 state-owned companies, including China Mobile Ltd, China Railway Rolling Stock Corp, and China Petroleum & Chemical Corp. China Chengtong is taking the lead.

Xiao Yaqing, head of SASAC, said the fund will finance supply-side structural reforms to help pave a sustainable growth path by means of SOE upgrades and industrial consolidation.

"There are some heavy industry sectors that have too much capacity, and there are some others (with capacity) in short supply. That's because sales of lower-end products remain sluggish, while we are not able to meet the demand of high-end goods," he said, adding that the fund will help move state capital up the value chain and expand the supply of high-end products.

China is revamping its massive state sector with the focus on mergers and acquisitions and overcapacity reduction in some debt-ridden industries such as steel, cement and coal.

The fund will help address those problems, and about 80 percent of the capital will be used in the restructuring of large-scale national companies, following market mechanisms, said Zhu Bixin, president of China Chengtong.

"We have a double-objective mission. One is to help serve supply-side reform, and the other is to secure the profits of our shareholders, so that's the challenge we are facing," said Zhu, also chairman of the China Structural Reform Fund.

Zeng Gang, banking research director at the Institute of Finance and Banking of the Chinese Academy of Social Sciences, said the fund will lower financing costs and optimize the financing structure in the state sector, compared with using bank loans.

"SOE reform is a very complicated process, requiring higher ability to manage the potential risks, and the state PE (private equity) fund is strong in long-term asset management and helps reduce SOEs' debt ratio," he said.

lvchang@chinadaily.com.cn