IMF official lauds RMB joining elite world currencies

The inclusion of the Chinese currency into the International Monetary Fund's Special Drawing Rights basket will not only help China's financial reforms but the evolution of the international financial system, according to IMF officials and think-tank economists.

Zhang Tao, the new deputy managing director of the IMF, said inclusion of the Chinese currency, the renminbi, makes the composition of the SDR basket more representative of the currencies being traded in the world.

"The RMB's inclusion will make it more attractive as an international currency, contributing to greater risk diversification," Zhang told a forum on Chinese economics on Wednesday at the Peterson Institute for International Economics in Washington.

Zhang assumed his current post on Aug 22, replacing Zhu Min, also from China.

A former vice-governor of the People's Bank of China, the central bank, Zhang said the inclusion of the RMB will also strongly support China's continued efforts to reform its monetary, foreign exchange and financial systems.

"It will help facilitate the country's increased integration in the global financial community," he said.

He believes the inclusion will help consolidate the process of RMB internationalization, adding that experience shows that currency internationalization can encourage the development of deeper and more liquid financial markets.

"It can deliver more predictable macroeconomic outcomes, assist the development of strong and credible institutions and secure the integrity of the markets," he said.

Zhang said that while these will be not achieved overnight, they can be crucial for China's continued emergence as a source of economic growth and financial stability.

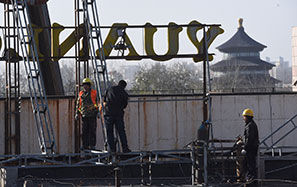

In November, the IMF executive board announced its decision to include the RMB in the SDR basket. That took effect on Saturday. The decision makes the RMB a new member in a basket of four other currencies - the US dollar, euro, British pound and Japanese yen.

Italian economist Fabrizio Saccomanni, a distinguished visiting fellow at the Peterson Institute, described the RMB's inclusion as an important recognition of China's growing role in the world economy and international monetary system.

He also described it as an important gesture by the international community to approach some kind of distribution of power in international financial institutions, an objective that's been pursued for some time and finally materialized.

"China's entry into SDR is implicitly a commitment that it will continue to move toward financial integration and opening its capital markets, which is certainly a process in the medium term," said Saccomanni, who had served as deputy governor of the Bank of Italy and as Italy's minister of economy and finance from 2013 to 2014.

Fred Bergsten, senior fellow and director emeritus of the Peterson Institute, said the US should warmly welcome the RMB.

"This is a historic development. It's a very important part of China's overall rise as a global economic power, a reflection of China's willingness to accept increased responsibilities as a leader of the international economy and international monetary system. I think it's wholly desirable," he said.

Bergsten believes it's historic for another reason. It's the first case in which a national currency is becoming a global currency at the behest and initiative of the issuing country. He said the US dollar, the British pound sterling, Japanese yen and the euro were all chosen by the markets, adding that some issuing governments were even reluctant to see their currency playing much of an international role.

"So I think China is breaking new territory here in actively seeking various responsibilities in an orderly and very timely way in an international role for its currency. I think it's historic in that sense," he said.

Bergsten warned his Chinese counterparts in the audience to be ready for some unanticipated consequences.

"Somebody might even start manipulating your currency one of these days as you play the international role," he said.

Bergsten proposed the creation of an SDR Council, or SDR5. He said that people who worry about international governance have thought for many years about how to form a new governing organization that includes many advanced countries along with China.

"They try to expand G7, but China does not like that. Some in the G7 do not like that either," he said. "But this is a natural opportunity."

He added that the council could be either inside or outside the IMF to work for the evolution of the international monetary system.

chenweihua@chinadailyusa.com