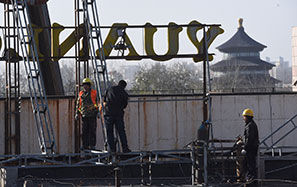

Forex reserves rise above $3 trillion

Experts say yuan depreciation may be reversed

China's foreign exchange reserves rose above the $3 trillion mark in February again, the first rise in eight months thanks to an improving export situation and slowing capital outflows.

Analysts said the trend of yuan depreciation may be reversed this year if China's economic fundamentals continue to improve.

The country's foreign exchange reserves rose by $6.92 billion in February to $3.005 trillion, the first increase since June 2016, data from the People's Bank of China, the central bank, showed on Tuesday.

In January, the reserves fell to $2.998 trillion, sparking heated discussions as to whether they would continue to fall and become inadequate for guarding the country's financial stability. The February rebound may ease such concerns, analysts said.

The rise in the reserves was partly due to the domestic economic recovery and higher exports in February, said Ren Zeping, chief economist at Founder Securities Co.

China's export growth was 15.9 percent in January, and it is expected to maintain similar growth in February. In 2016, the country exports fell by 2 percent year-on-year.

The yuan, meanwhile, stabilized in February. This, together with stricter implementation of foreign exchange purchasing rules, dampened capital outflows, contributing to rising foreign exchange reserves, Guotai Junan Securities Co said in a research note.

"The market mood was reversed in February and demand for the yuan rose, leading to the central bank purchasing dollars," said Deng Haiqing, chief economist with JZ Securities Co.

Meanwhile, bond yields in the United States, the European Union and Japan all dropped, causing rises in bond prices and a revaluation of reserve assets, he said.

The State Administration of Foreign Exchange said that China's foreign exchange reserves were likely to gradually stabilize as capital outflow pressures eased, as a result of China's improving economic fundamentals.

In the short term, the yuan has stabilized, but in the medium term it still faces some pressures from depreciation as the dollar may further strengthen thanks to improvement in the US economy and possible interest rate hikes by the US Federal Reserve, said Ren.

The Fed may raise interest rates as early as next week. He said if that happened, it may trigger capital outflows to the US from emerging markets, including China.

Yi Gang, deputy governor of the central bank, said during the ongoing annual session of the National People's Congress that China would stick to its managed floating exchange rate framework to keep the yuan stable.

xinzhiming@chinadaily.com.cn