Not an FDI exodus

Foreign direct investment in China fell by 7.3 percent year-on-year in January, the eighth consecutive month when China registered negative FDI growth.

The fall is in line with the weak global investment sentiment in 2012 and does not signal that China has lost its allure for investors. January's FDI figure indicates that investor confidence is yet to improve both for China and the world economy as a whole. As the global situation improves, it is likely that FDI in the country will pick up.

China attracted a total FDI of $111.7 billion in 2012, slightly lower than the level in 2011.

But this was still sound considering the global backdrop. Global FDI inflows dropped by 18 percent year-on-year in 2012 to about $1.3 trillion thanks to macroeconomic and policy uncertainties, according to a report released by the United Nations in January.

While the Chinese economy is believed to have bottomed out in the fourth quarter of 2012, it will take some time for the rebound to be reflected in investment. The structural weakness in the developed world, meanwhile, may continue to be a drag on FDI activities.

Although a mild slow-down is inevitable, the Chinese economy remains on the fast track, and no matter whether China's economy grows at 7 or 8 percent in the coming decade, it will still be one of the best performers, if not the best, among major global economies, which will not escape the notice of investors.

The fall in FDI inflows in China may also be a result of policy adjustment in both China and its trade partners.

On the one hand, China is restructuring its economic growth model and improving related legal and regulatory systems. During that process, the investment environment may undergo some changes before it becomes more predictable to investors.

China's success in making those changes happen will increase, not reduce, business opportunities for global investors.

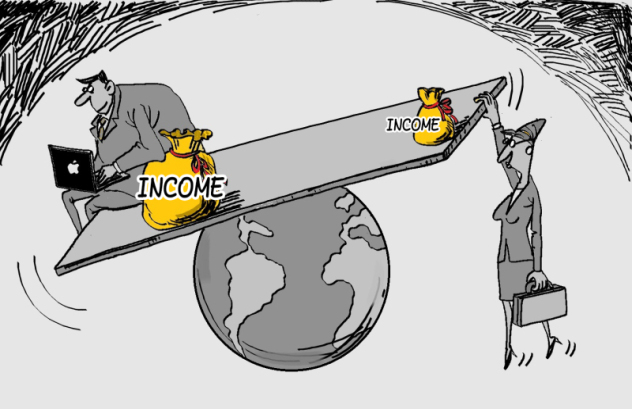

On the other hand, as product costs in China rise, and some of its trade partners, most notably the United States, are making initiatives to attract investors, some investors may leave China.

So far, however, there is no sign of an investment exodus from the world's second-largest economy.

(China Daily 02/21/2013 page8)