Market agrees fundamentals are strong

Like a weak patient recovering from a long illness, the Chinese stock market, after an encouraging spurt in the past several months, is suffering from a relapse.

Although the market's unstable condition shouldn't have surprised anyone, the relapse apparently has disheartened the team of stock analysts and the army of investors who found their earlier bullish prognosis shattered by the latest price reverse.

Indeed, the government's renewed efforts to clamp down on the property market that once again was showing signs of overheating wrecked the nerve of many investors, sending them into a stampede to dump their holdings while there was still profit to be made. Back in the minds of many analysts and investors is the gnawing worry that the central bank is moving to tighten credit to ease inflationary pressure.

Such worries short-circuited an earlier rally that pushed the Shanghai Composite Index up by about 22 percent, despite occasional faltering, to a high of 2,432.50 on Feb 8, just before the long Chinese Lunar New Year break, from about 2,000 a few months ago. Since the market reopened after the holiday, the index has plunged almost 10 percent from the latest peak to about 2,200.

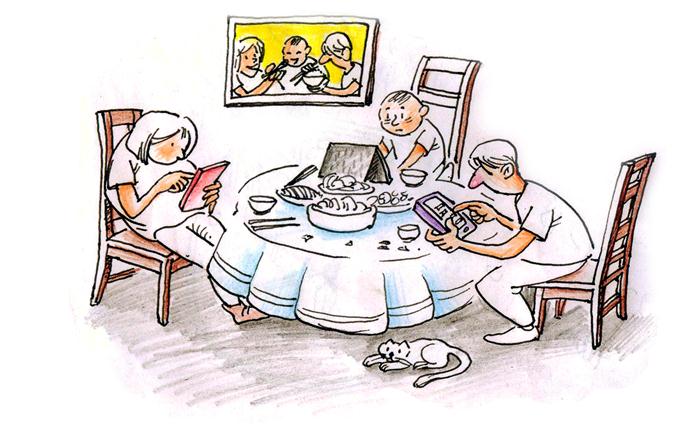

As usual, the Internet is rife with opinions and rumors started by self-styled investment gurus in their blogs. Numerous financial news publications and websites are carrying multitude of stories trying to make some sense of the sharp change in market sentiment.

In a market heavily influenced by the finicky mood of hundreds of thousands of individual investors, many of them staking their pensions or life savings in the hope of making some quick money, any news - especially those relating to the all-important property sector - has the potential to be blown out of proportion.

It is easy to make a connection between the government's housing policy and stock market performance. To be sure, the property sector has only a small impact on the index because many of the largest developers are not listed. But the movement of property prices can have a far-reaching impact on corporate earnings, especially those of banks, because of the vast amount of their property-related loans.